Cryptocurrency has exploded over the course of 2020. Most of the attention is still on the King of Crypto: Bitcoin (BTC). It has put on a strong performance in the last half of 2020 and there are rumblings that we could see six figures in a year or so.

Although altcoins have not seen as strong a financial performance as Bitcoin over the new year, the stars are beginning to align and altcoins are set for a strong performance for five reasons.

1. The Paypal Effect

Paypal’s bombshell announcement that it would allow its users to buy (and eventually spend) cryptocurrency within its network was hugely important. One of the big barriers to cryptocurrency adoption has been access. Paypal making it easier to purchase cryptocurrency, even if it is within its own walled garden, will act as a flood gate for a huge amount of capital into the cryptocurrency market.

Other companies have already begun to follow Paypal into the crypto world. For example, the crypto startup Lumi has created a crypto wallet that will enable users to buy cryptocurrency using Apple Pay. A number of cryptocurrency exchanges have also begun to allow Paypal cryptocurrency purchases.

The effects of this influx of new capital will likely be a big boost to Bitcoin at first as new users seek to familiarize themselves with cryptocurrency. However, as time moves on, it seems likely that more users will seek to purchase altcoins, particularly as demand for crypto in general constricts the supply of Bitcoin.

2. Institutional Investors Will Constrict Supply

Over the course of December there has been a tidal wave of institutional investors announcing their foray into the crypto world. JP Morgan is predicting around $600 billion in capital to flow into the cryptocurrency ecosystem from institutional investors. For the time being this will largely be focused around Bitcoin, which could help drive up its price thanks to scarcity.

There is a fixed amount of Bitcoin available in the world at any one time. This means that sudden influxes on demand can constrict supply, especially if existing BTC holders decide it’s too early to sell. High demand from institutional investors could see late comers being forced to look for Bitcoin-like products that could serve as a decent alternative.

The most obvious candidate for this is the silver to Bitcoin’s gold, Litecoin (LTC). Litecoin was designed to act as a secondary currency for Bitcoin, and might become the crypto of choice for investors who find themselves unable to source BTC. This would drive up the price of LTC as demand for BTC outstrips supply.

There is precedent for this sort of interaction in the real world. In August 2020 SIlver saw a significant spike in demand, at least in part driven by investors feeling priced out of gold. It is likely that the relationship between BTC and LTC will be similar.

3. The Decentralized Finance Boom

One of the big leaps forward in 2020 was for decentralized finance (DeFi). These are apps designed to be decentralized alternatives to real-world financial institutions and products. In 2020, the DeFi ecosystem saw significant progress, largely driven by lending platforms and exchanges. As of December 14th, the total locked value in the DeFi world was roughly $14.62 billion.

Decentralized apps represent one of the few ways that users can make their crypto assets work for them — at least without liquidating them.

The most common way to do this is through a process called Yield Farming, which enables investors to “stake” a portion of their cryptocurrency that others are then able to borrow. In return for taking on a small level of risk, users who stake their crypto are rewarded with an interest rate that typically far outstrips anything available on the traditional market.

The challenge for DeFi is that it is largely based on the Ethereum blockchain. Ethereum is still based on Proof of Work (PoW) consensus, which means that transactions are slow to process. When a lot of DeFi projects are operating simultaneously this increases costs and slows the network to the point where it is unusable. This could be about to change, however.

4. Ethereum 2.0 and the Switch to Proof of Stake

One of the most anticipated moments in recent crypto history is finally on the horizon: Ethereum 2.0. This major overhaul to the blockchain is designed to significantly improve the functionality of Ethereum and remove one of the biggest bottlenecks to the platform’s growth, PoW consensus.

Ethereum decentralized apps (Dapps) make up the bulk of new crypto projects. These projects typically use smart contracts in order to solve particular problems. Each smart contract is essentially a transaction on the Ethereum blockchain with code appended that records specific metadata on the Ethereum blockchain. For example, you could use a smart contract in lieu of an escrow account during a property sale.

The problem with this is that each transaction needs to be processed and, as mentioned above, Ethereum uses PoW. That requires miners to solve increasingly complicated equations in order to validate a specific block on the chain. This means that when there are a lot of transactions on the network it takes too long to process them all. This happened in 2017 when the game CryptoKitties caused a significant slowdown on the Ethereum blockchain.

Ethereum 2.0’s solution to this problem is to change to a Proof of Stake (PoS) consensus method. This means that anybody who holds Ethereum tokens (ETH) will be able to lock them in order to process a transaction. In order for a transaction to process a minimum of 32 ETH is required, but staking pools are available to make it possible for everyone to participate.

In exchange for staking their cryptocurrency, Ethereum investors will be rewarded with a transaction fee. This provides a new way for Ethereum holders to make money without liquidating their currency. Most importantly, however, it provides a more efficient platform for smart contracts and ERC20 tokens, which should help stabilize the DeFi World.

5. A Wave of Innovative Dapps

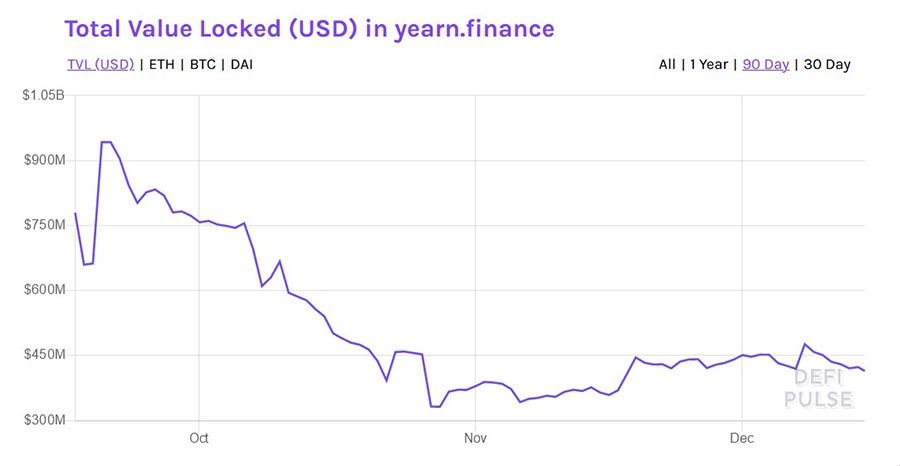

The limitations of Ethereum remain in place today, but that hasn’t stopped innovators trying to build bold new projects. One of the most interesting is Yearn.Finance (YFI). This project started life as a decentralized gateway and advisor into the world of DeFi. It experienced a boom in October and has declined and then stabilized over the course of November and December.

Despite Yearn.Finance’s relatively small market share today, it remains important for its vision. The project is designed to be entirely decentralized. The founder gave away his entire “governance” stake to key liquidity providers in the project. This means that the future direction of the project is entirely in the hands of the community, a stance confirmed by the recent manifesto release.

Building a More Robust Ecosystem

The sum of the previous five effects will lead to a more robust crypto ecosystem overall. Increased capital, both from PayPal and institutional investors, will help to bring new underlying value to the sector. As investors begin to look outside of Bitcoin, which will eventually happen, we will likely see a second wave of capital hitting promising cryptocurrency projects.

This new capital will help bring new liquidity into the altcoin market but the real game changer is the development of a proper finance ecosystem. DeFi and Ethereum 2.0 will give the crypto world decentralized alternatives to loan platforms, currency exchanges, and countless other institutions like real estate brokers.

This will give projects like Yearn.Finance more room to grow and make it more viable for developers to build new ideas. In the long term this will make the altcoin space far more vibrant than Bitcoin could be alone, and help create new opportunities in a decentralized infrastructure.

Contributed by Toni Allen

Updated on 18th December 2020