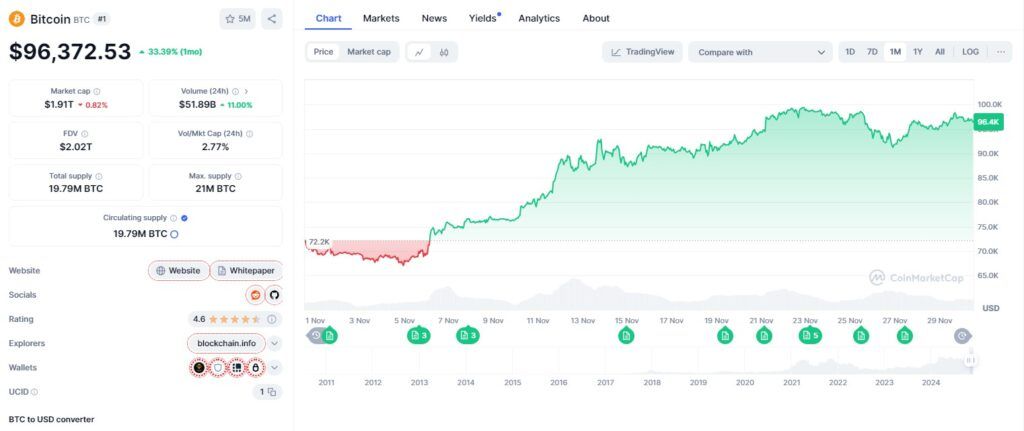

Bitcoin bulls are once again aiming for the pivotal $100,000 resistance mark, with the cryptocurrency surging to $97,290. This renewed upward momentum follows a turbulent week where Bitcoin dipped near $92,000 before regaining strength.

Market sentiment appears strongly bullish, driven by a combination of factors such as increased institutional interest and supportive on-chain metrics. Key indicators, including the Miner Net Position, HODL Waves, and net exchange flows, reveal a promising trajectory for Bitcoin as December begins.

On-Chain Metrics Indicate a Supply Crunch

On-chain data underscores a bullish outlook for Bitcoin, highlighting a constrained supply environment as the digital asset nears the $100,000 milestone.

The Miner Net Position metric shows a notable decline in miner selling pressure, as evidenced by the shrinking red bars on charts. Traditionally, miners have been major suppliers of Bitcoin to the market, but this shift indicates that miners are now holding their reserves in anticipation of higher prices.

Historically, reduced miner selling has limited Bitcoin’s immediate supply, paving the way for upward price momentum. The decline in selling pressure aligns with Bitcoin’s recovery above $92,000, reinforcing a favorable environment for bulls.

HODL Waves Reinforce Long-Term Confidence

The HODL Waves metric further strengthens the bullish narrative by showcasing a steady increase in long-term accumulation. A significant expansion in holding bands exceeding one year highlights strong conviction among long-term investors.

Conversely, a noticeable contraction in short-term holding bands (ranging from one day to three months) points to reduced speculative activity. This shift diminishes the liquid Bitcoin supply available for trading, historically creating favorable conditions for sustained price increases.

This behavior reflects growing confidence among investors regarding Bitcoin’s long-term potential, particularly as the asset continues to gain traction with institutional players and retail investors alike.

Net Exchange Flows Indicate Accumulation

Supporting this analysis, net exchange flow data reveals consistent Bitcoin outflows from exchanges—a clear indicator of investor accumulation. When holders transfer Bitcoin to cold wallets, the liquid supply available for trading diminishes, thereby increasing the likelihood of upward price movement.

This trend underscores the bullish sentiment dominating the market, with reduced selling pressure and rising demand creating a supply-constrained environment.

Breaking $100K Could Lead to New Highs

As December progresses, these on-chain metrics suggest a market primed for further growth. Overcoming the psychological $100,000 barrier could act as a catalyst for Bitcoin, potentially driving it to new all-time highs in the coming weeks.

By Andrej Kovacevic

Updated on 9th March 2025