Bitcoin’s Market Tumble Triggers Over $145 Million in Liquidations

In a volatile 24-hour window, more than $145 million in Bitcoin long positions were liquidated as prices tumbled to their lowest in months. Market analysts attribute the sharp decline primarily to reduced interest from investors in the United States, which significantly influenced the recent market downturn.

The total value of liquidated Bitcoin positions reached $166 million. Concurrently, the cryptocurrency market experienced a hefty $463 million in liquidations, with a staggering $398 million in long positions, data from Coinglass reveals.

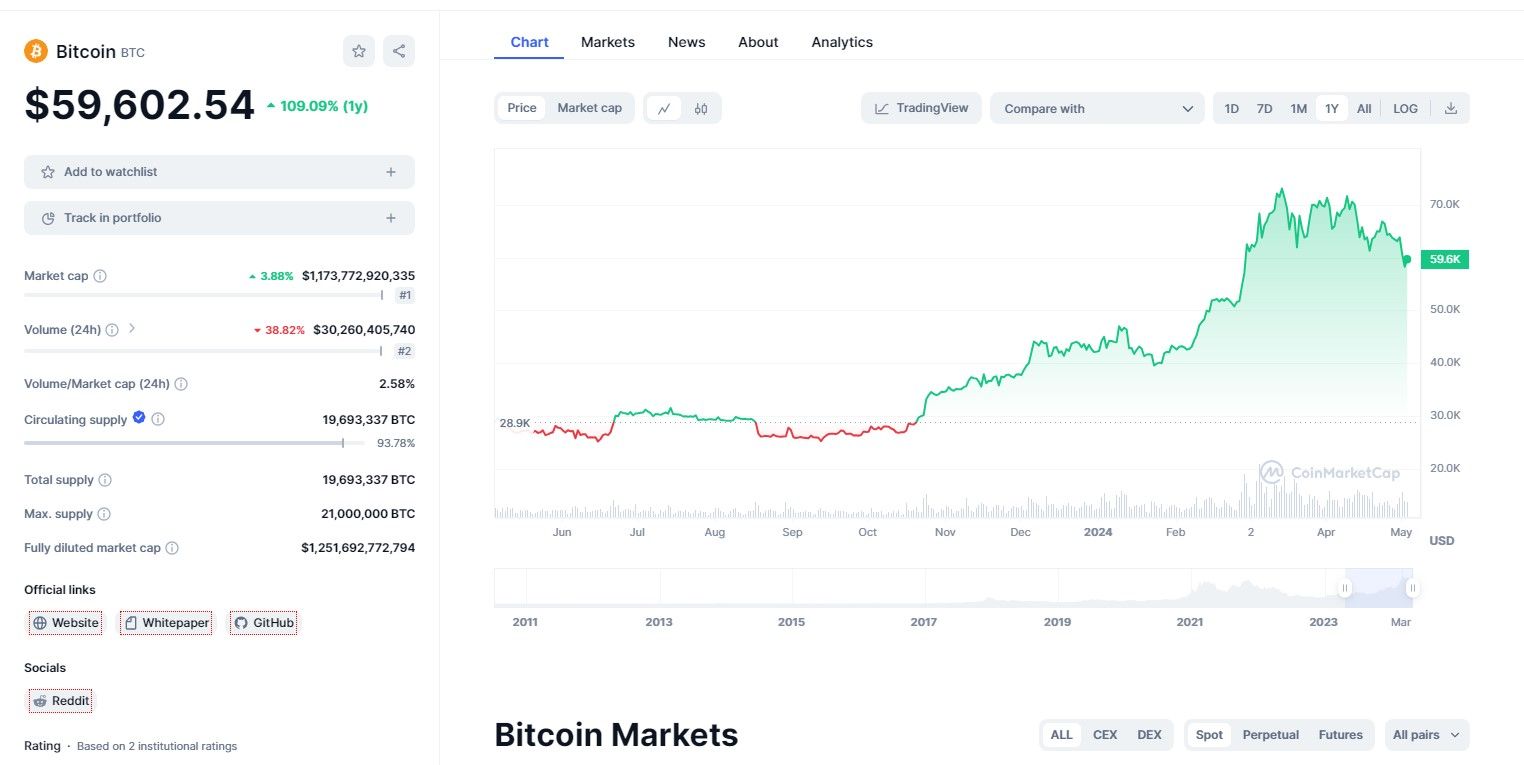

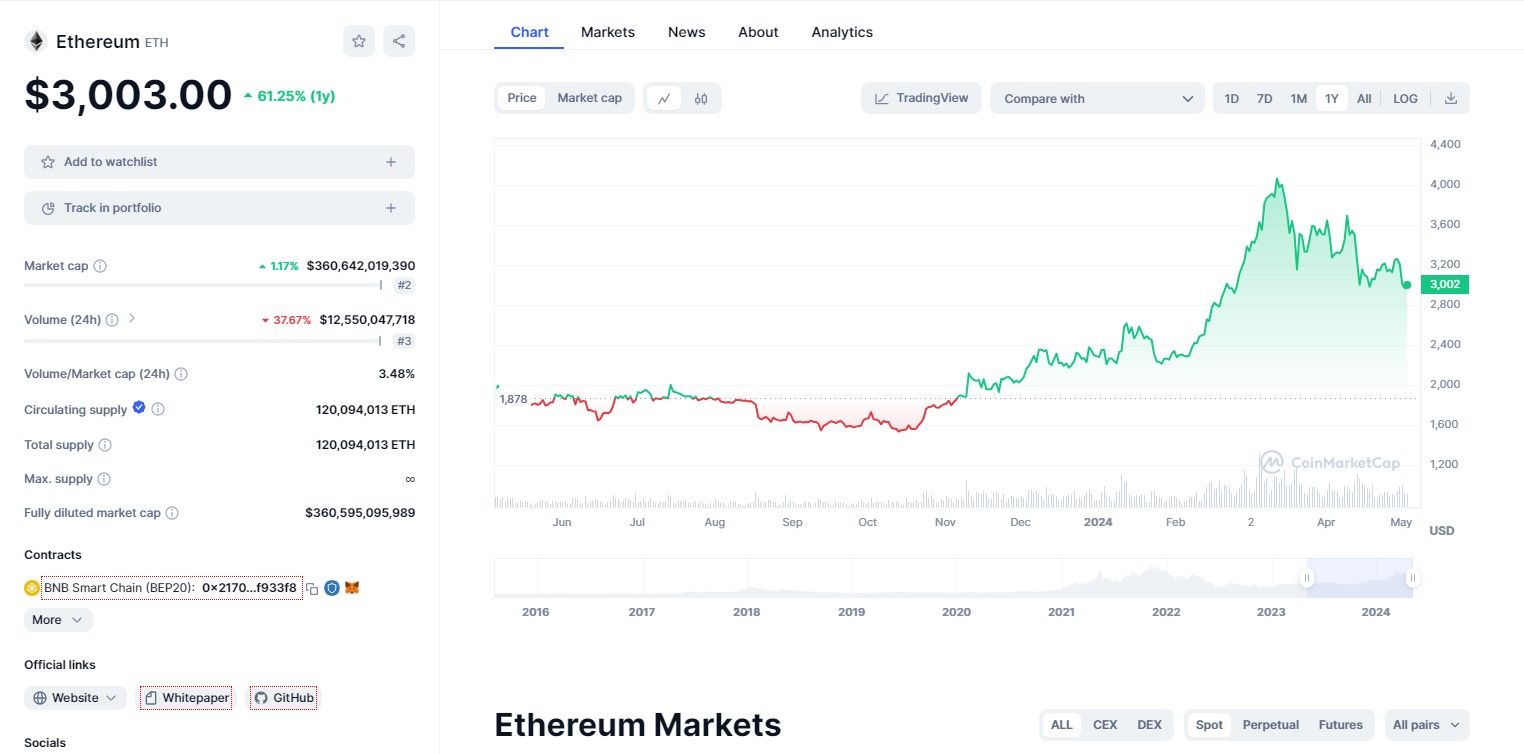

Currently, Bitcoin teeters just above $57,000 after a nearly 8% drop in the last day, trading at $57,161 as of early morning, according to data from The Block’s Price Page. Meanwhile, Ethereum also saw a decline, dropping 6.2% to a trading price of $2,870.

Market Correction Triggered by Declining Demand

This week’s analysis from CryptoQuant indicates a significant slowdown in demand growth for Bitcoin among prominent investors and long-term holders. After peaking in March, the demand from large-scale Bitcoin holders has diminished, with the monthly growth rate halving from 12% to 6%.

The reduction in demand is notably reflected in the declining Coinbase premium, which has fallen below zero recently. This dip suggests a diminished eagerness among U.S. investors to acquire Bitcoin at prevailing prices.

Additionally, the U.S. spot Bitcoin ETF market appears poised to register its first net outflows since launching earlier this year on January 11, indicating waning interest from institutional investors.

Revised Price Expectations for Bitcoin

CryptoQuant analysts now predict Bitcoin’s price might settle between $55,000 and $57,000. This new range is approximately 10% lower than the current $63,000 cost basis for traders, which has historically served as a crucial support level in bullish phases.

Moreover, there has been a noticeable uptick in Bitcoin being sold by miners, reaching the highest levels of daily sales since the start of the year, which further pressures the price.

As Bitcoin’s market share slightly decreases to 50.3%, Ethereum’s share has marginally increased to 15.7%. The total market cap for cryptocurrencies has declined by 6.5% over the past day, now standing at $2.25 trillion, as per The Block’s Prices Page. The GM 30 Index, which tracks 30 leading cryptocurrencies, also fell by 6.8% to 118.77.

By Andrej Kovacevic

Updated on 14th July 2024