Bitcoin Hashprice Hits Record Lows: What You Need to Know

The reward for Bitcoin miners per terahash per second (TH/s) per day, known as the “hashprice,” has reached historic lows. A perfect storm of factors is forcing many small and medium-sized miners to capitulate.

Miners’ Daily Rewards and Market Conditions

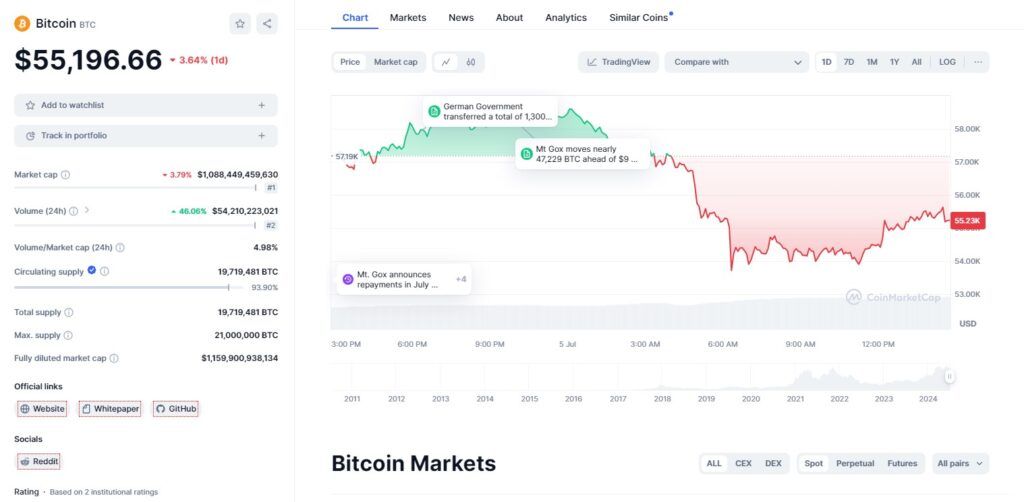

The daily reward for miners currently stands at $29 million. Before the April halving, this figure was around $79 million. Additionally, the price of BTC in the spot market has dropped significantly over the past few weeks. This Thursday, the price hit a multi-month low, dropping to $56,700 per coin.

Rising Production Costs

Parallel to this, the production cost per BTC has reached notable highs. According to data from MacroMicro, as of this Tuesday, mining one BTC cost over $72,000. This negative differential is putting enormous pressure on mining companies, especially smaller ones.

Forced Liquidation of Reserves

As a result, miners are being forced to liquidate their reserves. According to CoinDesk, the level of capitulation among mining firms is comparable to the levels seen during the FTX collapse at the end of 2022. These factors are driving the Bitcoin hashprice to all-time lows.

Unprecedented Decline in Hashprice

In June, Riot Platforms’ hash rate increased from 22 EH/s to 31.5 EH/s, marking a 50% rise in its mining capacity. However, this increase does not make the company profitable. Generally, market conditions require BTC to reach at least $75,000 for Riot to operate at a profit. This situation is even more challenging for smaller companies.

Current Hashprice Figures

As shown in the graph from The Block, the Bitcoin hashprice is now at $0.048 per TH/s per day. Just before the halving, this reward was $0.11. Until June, it was $0.064. This gives an idea of the current state of the mining industry.

Conclusion

The Bitcoin mining industry is facing significant challenges due to the historic lows in hashprice. Rising production costs, a decline in BTC prices, and forced liquidation of reserves are pressuring mining companies. Monitoring these trends and understanding their implications is crucial for stakeholders in the cryptocurrency space.

By Andrej Kovacevic

Updated on 18th July 2024