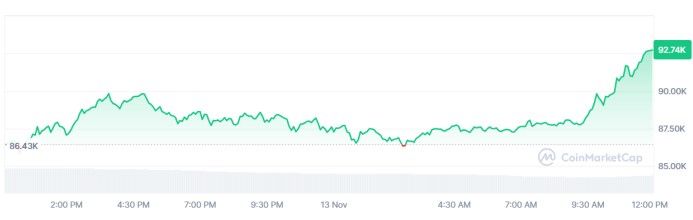

Bitcoin achieved a fresh all-time high (ATH) this Wednesday, reaching $93,374. After a slight pause on Tuesday, Bitcoin’s price surged, positioning it just steps away from the historic $100,000 mark. According to CoinMarketCap, this latest high was recorded as of the article’s publication time.

Following an intense session on Monday, some analysts anticipated a potential correction that might temporarily dip the price. However, Bitcoin defied these predictions, showing once again its resilience against traditional forecasts. Throughout today, it remains possible we’ll see more record-breaking highs similar to Monday’s performance.

The recent price boost appears connected to strong demand for shares in Bitcoin ETFs. Notably, BlackRock’s IBIT fund has experienced significant capital inflows, with combined investments of nearly $1.5 billion on Monday and Tuesday. If this momentum continues, Bitcoin ETFs could record yet another day of inflows exceeding $1 billion, suggesting that BTC’s bullish trend could carry forward through the week. For now, this new ATH is sparking excitement among investors, who see the $100,000 milestone as an imminent goal.

Will Bitcoin Reach Its ATH of $100K This Week?

With Bitcoin’s current trajectory, a breakthrough to $100,000 seems highly likely. However, it’s important to recognize that this barrier may pose a challenging resistance level. This resistance means that some investors might opt to take profits just below the $100,000 mark.

Bitcoin investors are often driven by speculative factors, which can lead to swift sell-offs at any hint of profit-taking. These rapid market reactions are a familiar pattern in the volatile crypto sector.

Regardless, Bitcoin—the dominant force among digital currencies—has shown a remarkable performance, surging by over 52% in just three months. This impressive climb is even more striking considering its massive market cap of $1.81 trillion at the time of writing.

Donald Trump’s victory in the recent U.S. elections on November 5 has fueled this rally. Although Bitcoin’s upward trend may extend into 2025, substantial corrections are still possible, with potential price drops in the short term. For investors, staying informed on market developments is essential in navigating this ever-evolving landscape.

By Andrej Kovacevic

Updated on 9th March 2025