According to renowned analyst and trader PlanB, Bitcoin‘s price is set to average an astounding $500,000 per unit between 2024 and 2028. This prediction suggests a potential gain of approximately 730% from its current price of $60,000 per unit.

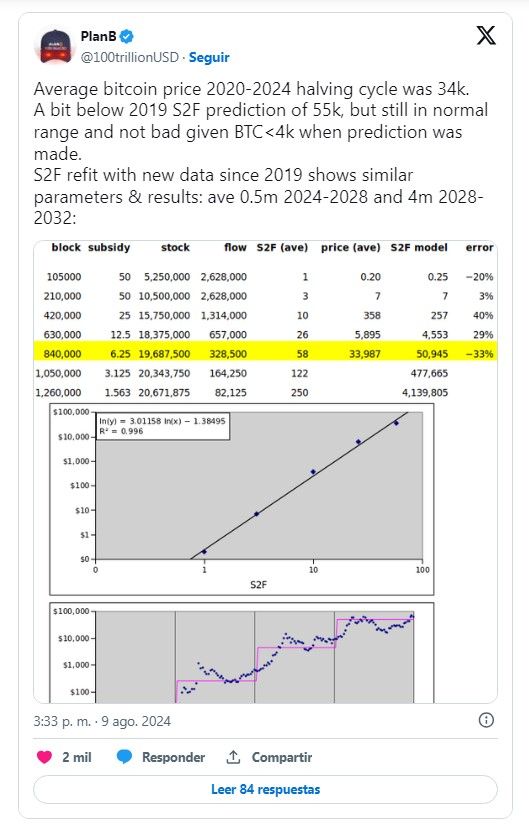

In a recent post on the social media platform X, PlanB clarified that this projection represents an average price range, indicating that Bitcoin’s value could be significantly higher during this period. Between 2020 and 2024, the average BTC price was $34,000 per coin, and PlanB’s predictions suggest this average could soar to $55,000.

Looking further ahead, PlanB anticipates that between 2028 and 2032, Bitcoin’s average price could reach an impressive $4 million per coin, marking an increase of over 6,500% from the current price. This bold prediction stands out in the cryptocurrency world today.

It’s essential to note that PlanB’s forecasts are based on technical analysis, leveraging his well-known Stock-to-Flow (S2F) model, which has sparked considerable debate. Although he predicted Bitcoin would hit $100,000 in 2021, which did not happen, PlanB continues to defend his predictive model’s validity.

Could Bitcoin Reach PlanB’s Predicted Price?

There are compelling reasons to believe that Bitcoin’s price could achieve significant heights in the coming years. One key factor is the potential victory of Donald Trump in the upcoming U.S. presidential elections this November.

The Republican businessman has promised a favorable regulatory environment for cryptocurrencies, which could stimulate the sector’s growth, increase investments, and promote widespread consumer adoption. Moreover, Trump has stated that he would include Bitcoin in the United States’ strategic reserves.

This particular move is noteworthy, as it would involve purchasing at least 1 million BTC during his term, aiming to accumulate coins over the next 20 years and use these assets to reduce U.S. public debt. If this scenario unfolds, Bitcoin’s market capitalization could skyrocket dramatically.

Under these circumstances, predictions from figures like PlanB, Michael Saylor, and Cathie Wood might seem more attainable. Investing in Bitcoin today with an eye on the future could offer an opportunity akin to investing in 2010.

By Andrej Kovacevic

Updated on 10th August 2024