Coinbase, the largest U.S. cryptocurrency exchange by trading volume, announced today that it is rolling out support for the Lightning Network. This integration offers a faster and more cost-effective method for its users to send, receive, or pay with bitcoin directly from their accounts.

Previously, bitcoin transactions on Coinbase were processed on-chain, meaning they could take between 10 minutes and two hours to complete, incurring high fees during periods of network congestion.

Launched in 2017, the Lightning Network is a Layer 2 protocol built on top of the Bitcoin blockchain, designed to solve scalability issues through bi-directional payment channels. These channels enable near-instant, low-fee transactions off-chain without immediate settlement on the base layer.

“Growing Bitcoin adoption increases financial freedom globally. I’m thrilled that our Lightning integration is now live, making Bitcoin more accessible and convenient worldwide,” said Viktor Bunin, Coinbase’s protocol specialist and lead for Lightning integration. Speaking to The Block, he added, “Providing faster and cheaper BTC payments through our partnership with Lightspark is another significant milestone for the ecosystem.”

Fees on the Lightning Network consist of a flat base fee as low as one satoshi—the smallest unit of bitcoin, equivalent to less than $0.01—and a liquidity provider fee or a percentage charged on the payment’s value. Network node operators can set their fees at various levels to compensate for providing liquidity.

Bunin informed The Block that there is a 0.1% processing fee for Lightning transactions on Coinbase for sends, which are typically processed within a few minutes. At launch, Coinbase users will be limited to a maximum withdrawal of $2,000, equating to a maximum fee of $2. This rate is higher than the average for Ethereum Layer 2 transactions but lower than those on the Bitcoin blockchain.

“A conservative limit was set because, although Lightning can handle arbitrarily large BTC sends, the average success rate of payments decreases as the size increases,” Bunin explained. “Setting a lower limit at launch will improve our customers’ experience and can be adjusted based on customer feedback and as liquidity on the network grows.”

In a statement to The Block, Coinbase claimed that its Lightning Network integration has reduced the cost for its customers to send bitcoin globally to a fraction of the typical 2% fee charged on credit card transactions and well below the $30 typically paid for wire transfers.

Although the integration allows users in supported regions to choose between Lightning and the Bitcoin base layer for withdrawals and payments, Coinbase did not specify which regions would be supported at launch. “The Lightning Network Integration is not available in all regions at present. We are rolling out support as feasible,” said Bunin.

Collaboration with Lightspark

Coinbase partnered with Lightning Network infrastructure firm Lightspark for this integration. Lightspark is led by CEO and co-founder David Marcus, formerly a leader at PayPal and Meta, including the latter’s Diem stablecoin project.

The decision to select Lightspark as Coinbase’s integration partner was announced on April 3, with Marcus calling it another “significant milestone” for Lightning at that time.

“We opted for a non-custodial integration partner because Lightning’s design includes significant components regarding channel liquidity management and route success rates,” Bunin explained. “It made sense to leverage the expertise of a partner focused on addressing these challenges while Coinbase concentrated on securing our clients’ assets and enhancing their user experience with Lightning.”

“Partnering with Coinbase to introduce Lightning payments to their customers is a key milestone in our shared goal of delivering real solutions for Internet payments,” Marcus commented on the rollout. “Working closely with the Coinbase team has been an excellent experience, and we’re excited that millions of people in many countries can now send fast, cheap Bitcoin transactions.”

While there are currently no plans to integrate Lightning into Coinbase Wallet (its Web3 non-custodial wallet) or other Coinbase products or services at this stage, Bunin noted that the team will closely monitor the growth of the Lightning Network and its adoption by Coinbase customers to guide any potential expansions into products like Coinbase Wallet or its crypto payments service, Coinbase Commerce.

“While we don’t know how many customers will use Lightning to send BTC, we’re encouraged by the traction we’ve seen for Layer 2s in other ecosystems,” Bunin continued. On Ethereum, approximately 35% of ETH sends were made through Layer 2 protocols like the Coinbase-incubated Base network, he added, noting, “Usage, adoption, and traction of Layer 2s on Bitcoin and Ethereum are clearly different, but we generally expect Layer 2 usage to increase over time as users seek out cheaper and faster transactions.”

How We Got Here

Coinbase CEO Brian Armstrong first suggested that Coinbase would support the Lightning Network in April 2023. Coinbase then confirmed it would integrate the Bitcoin Layer 2 in September 2023, with Armstrong stating that bitcoin is the “foremost asset in crypto” and expressing enthusiasm about enabling faster and cheaper Bitcoin transactions.

Armstrong’s remarks followed a consultation process initiated a month earlier, which began after he responded to a post from Block CEO Jack Dorsey, who questioned, “Why do you continue to ignore Bitcoin and Lightning? What ‘crypto’ is a better money transmission protocol and why?”

“We’re exploring how to best add Lightning. It’s non-trivial, but I think it’s worth doing. I’m all for payments taking off in Bitcoin,” Armstrong said at the time. “Not sure why you think we’re ignoring Bitcoin—we’ve onboarded more people to Bitcoin than probably any company in the world. Let’s build it together.”

Coinbase joins Bitfinex, OKX, Kraken, and others in offering Lightning support Coinbase’s Lightning Network integration follows some of its major crypto exchange rivals. Bitfinex was the first major crypto exchange to offer Lightning Network support in 2019. OKX added Lightning support in 2021, Kraken in 2022, and Binance completed the integration in July 2023.

When asked why Coinbase had taken longer to integrate the Lightning Network than many of its rivals, Bunin said it was about evaluating the Layer 2’s maturity and adoption before implementing support.

“Coinbase’s mission is to increase financial freedom in the world, and supporting Bitcoin is a key part of that narrative. We’ve evaluated Lightning support for a few years before we decided to add support last year,” Bunin told The Block. “The key drivers in our decision were the continued growth and adoption of Lightning, advancements in the underlying technology, and our goal to bring on-chain payments down to 1 second and costing 1 penny.”

Beyond integrating Lightning support, Coinbase has also invested in several projects in the Bitcoin ecosystem through its venture arm, including self-custodial storage solution Casa, Layer 2 rollup Sway, and decentralized exchange Portal.

Lightning Network Adoption

Lightning Network adoption has grown significantly in recent years, with a current total capacity of nearly 5,000 bitcoins ($311 million), according to The Block’s data dashboard.

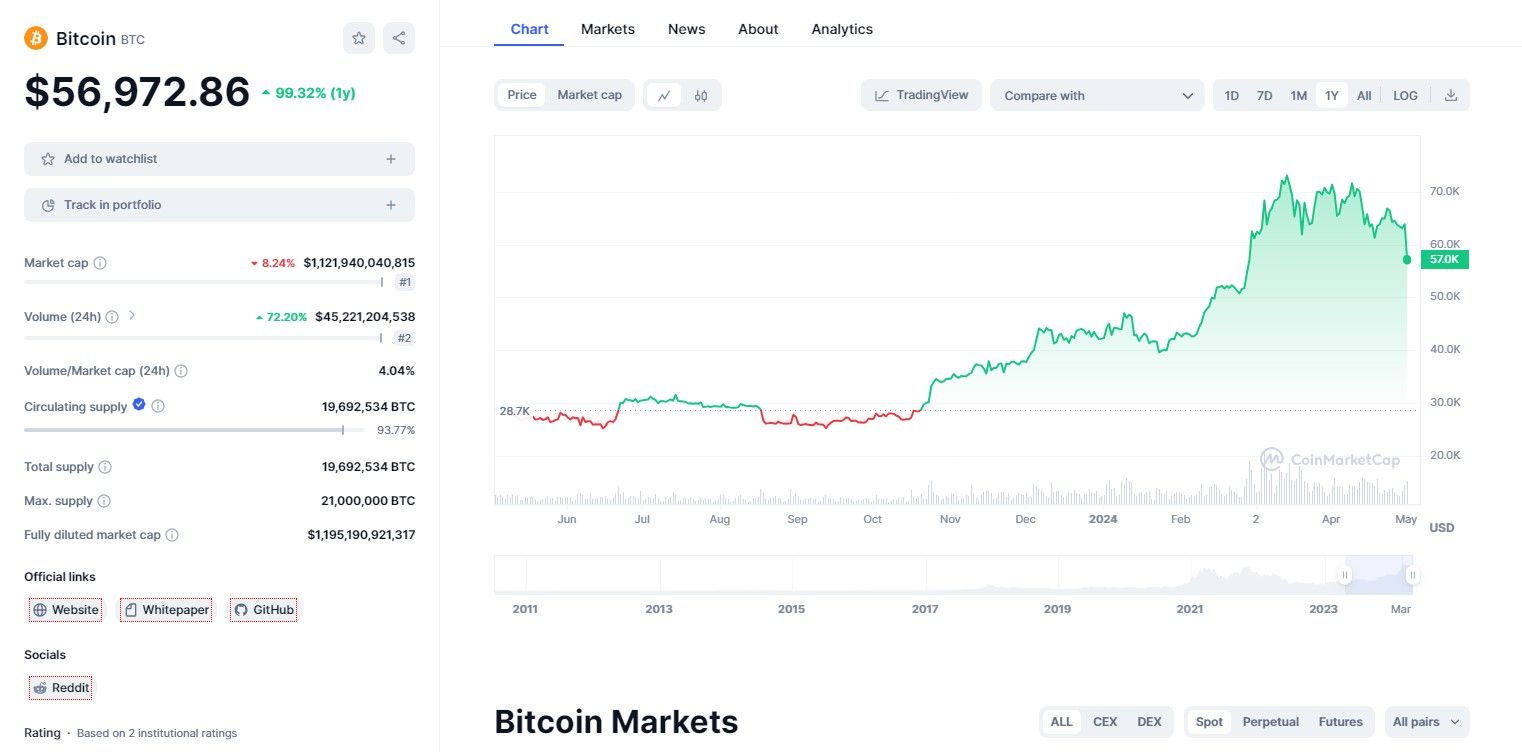

However, the capacity in bitcoin terms has fallen 12.9% from a peak of 5,640 bitcoins in July 2023 amid the run-up in bitcoin’s price. In U.S. dollar terms, Lightning Network capacity is down 9.6% from a peak of $344.2 million on March 13, as bitcoin approached its latest all-time high of $73,836.

By Andrej Kovacevic

Updated on 14th July 2024