On August 5, Bitcoin and Ethereum experienced a significant drop in value, causing a stir in the cryptocurrency market. Bitcoin’s price fell below $50,000, a surprising shakeup that caught many investors off guard. Within a mere two hours, the world’s most renowned cryptocurrency plummeted 14.41% from $58,350. Despite this dramatic fall, Bitcoin has shown some recovery and was trading at $51,776 according to Techloot data at the time of publication.

This price drop marks the lowest level Bitcoin has reached since February 26, when its value soared following the approval of Bitcoin spot ETFs in the United States.

Ethereum, the second most valuable cryptocurrency, also faced a significant downturn. Its value plunged by 21.61%, dropping from $2,695 to a low of $2,118 in the same period. As of now, Ethereum has regained some of its value and is trading at $2,280, based on our online crypto analysis tool.

Hackers Exploit Market Decline to Purchase Ethereum with Stolen Funds

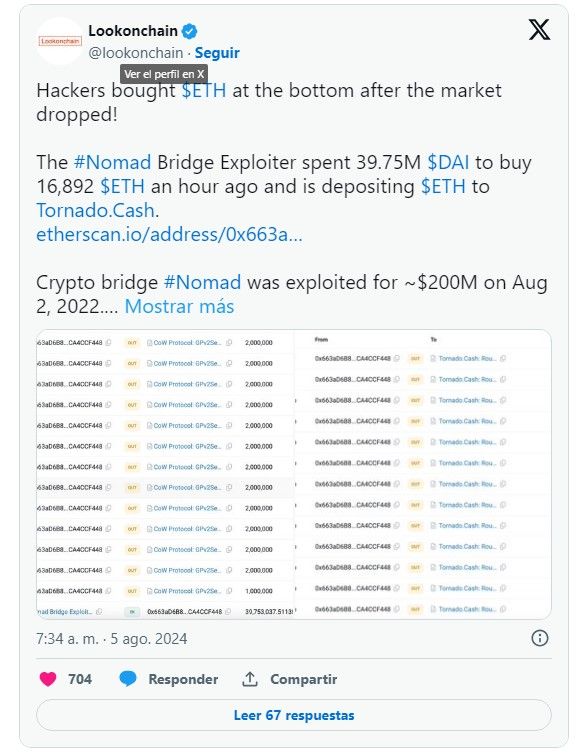

Amid the ongoing cryptocurrency market decline, hackers have seized the opportunity to purchase Ethereum at discounted prices using stolen funds from previous hacks. On August 5, hackers acquired 16,892 Ether with stolen cryptocurrencies linked to the 2022 Nomad bridge hack. This purchase occurred as Ethereum lost over 20% of its value.

Blockchain analysis firm Lookonchain reported that the Nomad bridge exploiter used 39.75 million stolen Dai to acquire the 16,892 ETH. Shortly after the acquisition, the hacker began transferring the stolen funds to Tornado Cash, a cryptocurrency mixer.

Hackers often use mixing services like Tornado Cash to obscure the on-chain traceability of funds, generally without intending to return the stolen assets.

Major Liquidation in DeFi Cryptocurrencies Following Jump Trading Movements

Top cryptocurrencies in the decentralized finance (DeFi) sector faced severe liquidation on Sunday night. Jump Trading, a proprietary trading firm, began transferring millions of dollars to various exchanges, causing panic among crypto investors. Concerns over economic and geopolitical headwinds led investors to withdraw quickly.

Fears of a recession triggered a significant sell-off in U.S. stock markets on Friday, with the unemployment rate rising to 4.3% in June. This news prompted global market declines, including a 5.5% drop in Japan’s Nikkei 225. Consequently, Bitcoin and Ethereum fell by 10% and 20%, respectively, as investors withdrew $780 million from long positions, indicating a shift towards safer assets like bonds.

The values of Maker, Lido DAO, UniSwap, Aave, and Chainlink were among the hardest hit within the top 100 tokens by market capitalization. Most of these tokens fell between 18% and 23%, marking their worst one-day performance since April, according to CoinGecko data.

Liquidations in Ethereum DeFi Protocols Hit Annual High of $350 Million

On-chain liquidations in Ethereum’s decentralized financial protocols have reached a new annual high, with over $350 million in positions liquidated in the last 24 hours, according to Parsec Finance analysis. This phenomenon occurs amid significant market volatility and a widespread sell-off in the cryptocurrency sector.

Most of these liquidations were concentrated in three major assets, significantly impacting lending protocols like Aave. The collateral in ETH accounted for the majority of the liquidations, with a total of $216 million in the last day.

Staked ETH (wstETH) followed with liquidations worth $97 million, and Wrapped Bitcoin (WBTC) also experienced significant liquidations, totaling $35 million.

Amid the rise in liquidations, Stani Kulechov, founder of Aave, highlighted that the decentralized lending platform generated $6 million in liquidation fees.

By Andrej Kovacevic

Updated on 5th August 2024