In the digital finance realm, the early months of 2024 have brought a notable 23% reduction in financial damages from cyber-attacks and deceptive schemes compared to the previous year, reveals a detailed analysis by Immunefi, a leader in blockchain safeguarding, dated March 28.

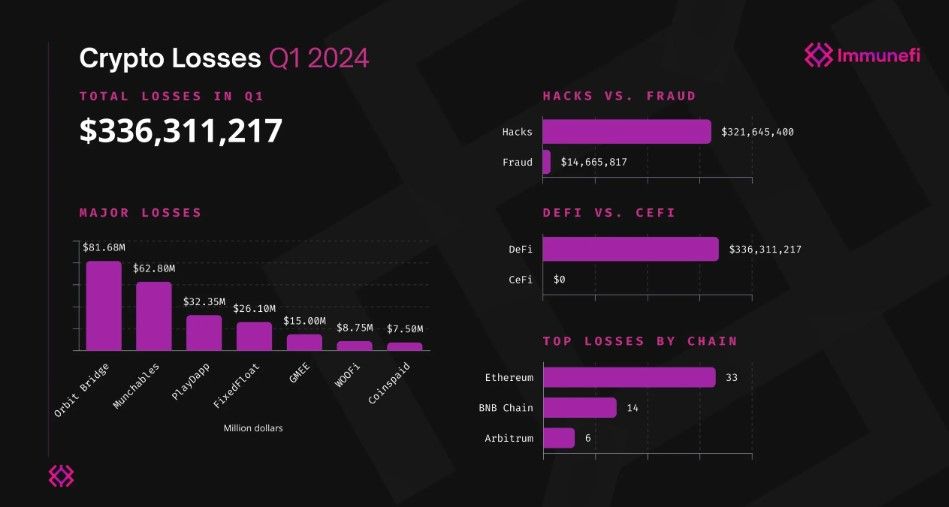

The comprehensive study outlines that the industry faced a downturn in monetary losses due to cyber incursions and deceitful acts in the first quarter, with figures falling to $336.3 million from the preceding year’s $437.5 million.

Immunefi’s scrutiny shed light on 46 cyber intrusions and 15 deceit instances, underscoring the persistent threats in the sector.

Despite the decline, decentralized finance (DeFi) platforms, boasting close to $100 billion in total value, continue to attract cybercriminal attention, with all recorded breaches in this quarter originating from this sector. In contrast, traditional centralized finance platforms reported no incidents.

The report highlights two significant breaches that led to a combined loss of $144.5 million, representing 43% of the total quarterly losses. The most substantial of these was an $81.7 million heist from the Orbit Bridge protocol on the last day of the previous year, with January witnessing the peak of financial losses amounting to $133 million during this quarter.

Immunefi’s CEO, Mitchell Amador, underscored the critical vulnerabilities within DeFi platforms, particularly concerning private key security, calling for an urgent reinforcement of both code and infrastructure safeguards.

In a notable incident, the Blast-based NFT game Munchables suffered a $62 million breach. However, in a turn of events, the stolen funds were swiftly reclaimed within a day after the perpetrator relinquished the assets back to Munchables.

The report also highlights a silver lining, with $73.9 million, or 22% of the pilfered funds from seven incidents, being successfully recovered. The overall number of cyber-attacks saw a 17.6% decrease, dropping from 74 in the first quarter of 2023 to 61 in the same period of 2024.

While hacking incidents constituted 95.6% ($321.6 million) of the quarter’s total losses across 46 events, fraudulent schemes including scams and rug pulls contributed to 4.4% ($14.7 million) across 15 events. Ethereum emerged as the most frequently targeted blockchain, followed by the BNB Chain, together accounting for 73% of the quarter’s total financial losses.

The Ethereum platform bore the brunt of the attacks, with 33 incidents leading to 51% of the total losses, while the BNB Chain faced 12 attacks, culminating in 22% of the losses. Additional breaches were identified across various platforms including Arbitrum, Solana, Optimism, Bitcoin, Blast, Polygon, Conflux Network, and Base, signaling a widespread concern across the crypto landscape.

By Andrej Kovacevic

Updated on 23rd April 2024