Activity on the Ethereum network shows a significant drop during August, according to recent data. Some key indicators are raising concerns among analysts and investors that interest in the network could be entering a prolonged negative phase.

The current environment in the cryptocurrency market is not the most favorable for investor stimulus. This could be a potential advantage for Ethereum, as it gives hope that network activity will improve if more favorable conditions for the crypto sector emerge soon.

Factors Highlighting a Decline on the Ethereum Network

According to data from The Block, the seven-day moving averages of daily trading volumes on Ethereum have dropped 55% over the past month. Meanwhile, daily economic activity in terms of U.S. dollars fell from $6.56 billion on July 26 to $2.9 billion currently.

Regarding monthly trading volumes, the news is not much more encouraging. The blockchain recorded a total of $134.71 billion in July. Meanwhile, the current volume for August sits at $91.46 billion, with five days remaining in the month.

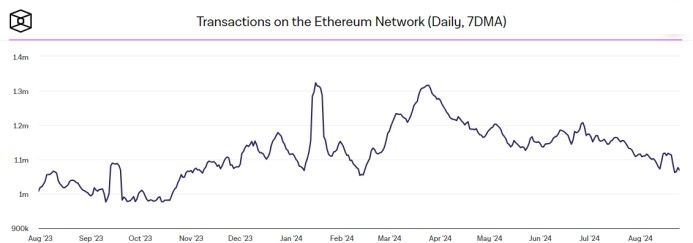

This reduction in trading volume indicates a decrease in overall activity, as well as a shift in market perception towards ETH. Additionally, the seven-day moving averages (as of last Sunday) show a similar downward trend. Approximately 1.07 million transactions were recorded during this period, representing a steady decline from the peak of 1.32 million daily transactions on March 25.

As can be seen, the decline in interest for Ethereum is evident with this drop in activity. For users, there are currently few incentives to engage in trading on this multi-purpose blockchain.

Monthly Transactions Also Decline

In terms of monthly transactions, Ethereum is also experiencing a noticeable drop. So far in August, 27.27 million transactions have been recorded, a figure not seen since May 2020. This number contrasts with the 35.49 million transactions recorded in July.

Although this situation raises concerns, not everyone views it with alarm. For example, some analysts from Coinbase, quoted by The Block, consider this behavior to be cyclical rather than a sign of prolonged disinterest.

Spot ETF Activity for ETH

The decline in interest is also reflected in Ethereum’s spot exchange-traded funds (ETFs). These investment instruments have not taken off as expected, and the pre-launch expectations were far from met.

In comparison to similar Bitcoin funds, Ethereum ETFs have shown poor performance. According to data from Farside Investors, Bitcoin ETFs saw positive flows on 9 out of the last 10 trading days. Meanwhile, ETH ETFs posted gains on only 3 of those days.

This gives an idea of institutional investors’ interest in the future of Ethereum’s native token. Analysts find this situation concerning, especially considering that the coin is now struggling to break the $3,000 barrier per token.

At the time of writing, ETH is priced at $2,723 per unit, according to CoinMarketCap data. Meanwhile, its 24-hour performance stands at 0.22%.

By Andrej Kovacevic

Updated on 27th August 2024