Ethereum continues to solidify its dominance in the blockchain space, with its Layer 2 (L2) networks achieving an all-time high in Total Value Locked (TVL) of $51.5 billion. This represents a staggering 205% growth compared to $16.6 billion recorded in November 2023, as per data from L2beat. This remarkable expansion underscores the growing adoption of L2 solutions designed to enhance Ethereum’s scalability while cutting costs and easing network congestion.

Leaders of the Layer 2 Ecosystem: Arbitrum and Base

The frontrunners in this expansion are Arbitrum One and Base, with TVLs of $18.3 billion and $11.4 billion, respectively, accounting for more than half of the total L2 ecosystem’s TVL.

In the final week of November, Arbitrum saw a 12% surge in its TVL, while Base climbed by 11.4%. Base also reached a milestone of over 1 billion cumulative transactions, hitting a record 106 transactions per second (TPS) on November 26, driven largely by the rising popularity of meme coins.

Dencun Upgrade and Its Ripple Effects

A critical driver behind this growth is Ethereum’s Dencun upgrade, rolled out in March 2024. The update, featuring EIP-4844, introduced data availability improvements, effectively stabilizing transaction fees across Layer 2 networks and boosting overall network capacity.

Notable platforms such as Starknet, Base, Zora Optimized Mainnet, and Optimism have reported transaction fee reductions of nearly 100%, making L2 solutions more accessible. Nick Dodson, co-founder of Fuel Labs, highlighted that the focus was not solely on reducing fees but also on achieving unparalleled scalability, making Ethereum’s L2 ecosystem increasingly attractive.

Challenges and Competition in the Layer 2 Space

Despite its success, the Layer 2 ecosystem faces challenges. Liquidity fragmentation across decentralized finance (DeFi) protocols and the potential for revenue diversion from Ethereum’s mainnet could impact ETH’s price trajectory.

Other notable contributors include Optimism with $7.99 billion and ZKsync Era with $1.12 billion in TVL. Meanwhile, smaller players like Linea and Starknet have also reported double-digit percentage growth, underscoring widespread adoption. Starknet, in particular, aims to quadruple its TPS while further slashing fees, positioning itself as a strong competitor to high-speed blockchains like Solana.

Ethereum’s Resilience and Market Position

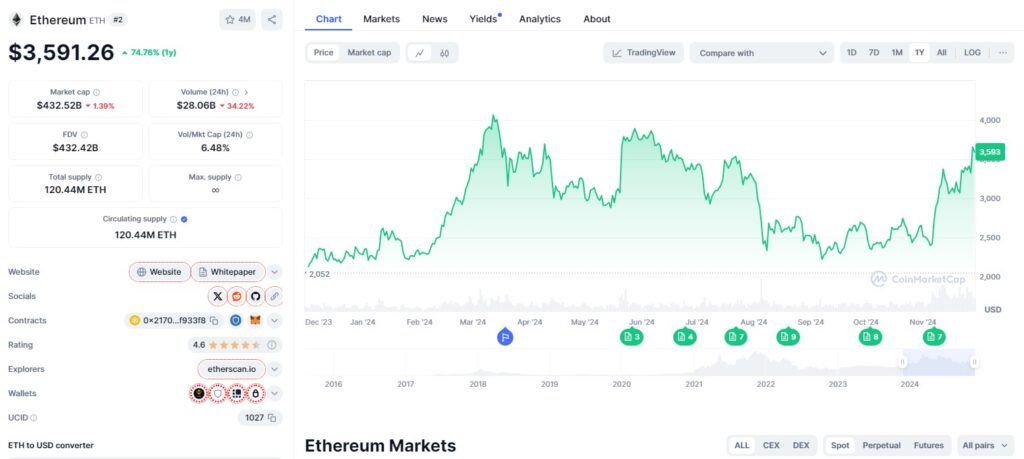

Ethereum’s price has shown resilience, rebounding to $3,579 after dipping to $3,000 last week. CME futures data further reflects investor confidence, with open interest hitting record highs.

The unprecedented TVL milestone highlights not only Ethereum’s adaptability but also the accelerating growth of its Layer 2 solutions, solidifying its position as a leader in blockchain scalability and innovation.

By Andrej Kovacevic

Updated on 9th March 2025