How to get Bitcoins ― Introduction

Bitcoin (BTC) is a virtual currency that isn’t backed by anything physical. If you bought a single Bitcoin about 4 years ago, you would’ve paid just under 800 GBP for it. However, if you want to sell that same Bitcoin today, it is worth over 5, 7000 GBP. The main reason Bitcoin is skyrocketing in value is that everyone wants to get their hands on them.

So, how does Bitcoin work and how do you get Bitcoins?

Bitcoin relies on a technology called the blockchain. A simple way to understand this is to imagine a ledger; every time someone buys or sells anything related to Bitcoin, it is recorded in this ledger (blockchain). The data is then copied thousands of times, every single hour and across multiple computers, to make sure all Bitcoin merchants are on the same page.

How to get cryptocurrency

There are different ways of getting Bitcoin with the most common being mining. In general, the methods are put into 2 big groups ― legal and illegal.

Legal

- Bitcoin mining

- Legal tender

- Bitcoin games

- Trading

- Buy and hold

Illegal

- Gambling (depending on the country)

- Hacking

For legitimate reasons, we will discuss only how to get Bitcoins legally.

Bitcoin mining

Mining is the most common way of getting Bitcoins. Most cryptocurrencies have a limited supply (Bitcoin, for instance, has a total of 21 million coins) and it is the job of miners to find these 21 million coins. Miners are rewarded with Bitcoins for any new… they find. The process requires the use of a sophisticated device such as the ASCI to get value from mining.

Advantages

- Transparency: There are no hidden costs.

- Stable value: When you earn and store Bitcoins using hardware wallets, the value is retained.

- Mining pools: These make it possible for miners to share their workloads and rewards.

Disadvantages

- You might have to join a mining pool to earn a substantial reward.

- Mining costs are very high.

Legal tender

Businesses are becoming more fascinated by digital currencies and are using them for transactions. According to a recent study done by Fundera, there are now about 15,174 global businesses accepting Cryptocurrencies, particularly Bitcoin as a means of exchange.

Tech giants are not left out too ― corporations like Microsoft, Apple (Apple pay) and NameCheap are fast jumping on the bandwagon.

You should too; that is if you run a business (you can include Bitcoins as an extra payment option) or need Bitcoins for personal use.

Advantages

- Straightforward: it’s simple to transact, and all you need is a wallet.

Disadvantages

- No refunds: the no refund policy may cause loss to both businesses and consumers.

- Rate fluctuations: Since the rates change, it might not be profitable when you convert back to fiat currency.

Airdrops

This method comes as a marketing stunt. What does that mean?

New cryptocurrency owners mainly use it at inception for promotional purposes. They send tokens or free coins to interested users to perform small tasks like retweeting, creating a trend, and increasing their popularity.

The first airdrop was the Auroracoin that was crafted for Icelandics. Currently, many apps have been developed for universal use. Bitcoin traders get notified about new airdrops on such apps.

Advantages

- Multi-Currency exchanges: Different exchanges (Coinbase, Ethereum) support the use of airdrops.

- High stake: You have a high stake and earn big in the long run.

Disadvantages

- Not all airdrops are profitable: Merchants have to be on the constant lookout to avoid being hacked.

- Most beneficial to cryptocurrency Influencers: Crypto trading platforms mostly acquire significant influencers to do surveys for airdrops (as brand awareness tactic).

Bitcoin games

Bitcoin online games are popular; however, the rewards are very inconsequential. They are called satoshis. To put into perspective, 1,000 = $0.06908605. These games pay about 30 satoshi per hour. You might have to be online for weeks to earn $2.

Advantage

- Fast and fun: Players enjoy indulging in these games and can also make extra bucks from surveys.

- Fosters interactions: Game enthusiasts from various countries not only play together, but they also make more friends from experience.

Disadvantage

- Time-consuming: Sometimes, all one can make is $0.60 per week.

- Meagre rewards: It is more of a distraction than a means of doing money business.

Trading

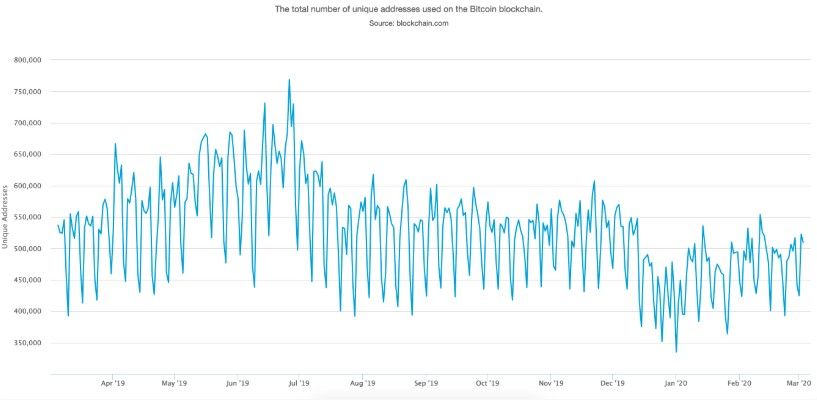

Trading BTC is the second most rewarding way to earn cryptocurrency. As seen in a report, at least 300,000 Bitcoin transactions take place daily. Just like it is with FOREX, the reward is as high as the loss. You must be careful as quite a number have lost life savings trading (without proper training).

Advantages

- Mega valuable: With the right signals and indicators, trading Bitcoins could be.

- High-profit margin: the profits are probably the highest when compared to other means of getting Bitcoins.

Disadvantages

- High risk: It is possible to lose all your investments in a single. In fact, no broker guarantees a profit.

Buy and hold

Buy and hold is often referred to as HODL. It used to mean to ‘HOLD’ but is now recognized as ‘Hold On for Dear Life’. For this option, users buy the cryptocurrency when the prices are low and sell when the prices get high. Some people have become millionaires buying Bitcoins at their inception and selling them a few years later. The trend is well-known among Bitcoin holders.

Advantages

- Broking: You can buy low and sell high.

- Appreciative value: If you can wait for three to five years, the returns could be massive.

Disadvantage

- Long wait before returns: Holders usually hoard coins for 2-4 years before significant appreciation.

- Unpredictable: An example was when Bitcoin hit an all-time high in 2017, users who bought it at the time have had to wait a couple of years. The problem is that in 2020, with the COVID-19 pandemic that is affecting Bitcoin prices and value, holders are even more uncertain.

For insights on this, you can watch this video from Cointelegraph:

Basic cryptocurrency terminologies

Altcoins

They are also called alternative coins. They refer to other cryptocurrencies asides Bitcoin, including Ethereum, Litecoin, and Bitcoin Cash (BCH)

Wallet

A wallet in the context of cryptocurrency means a software where you can store, track and retrieve digital currencies like Bitcoins. According to Statista, there are now 42 million Bitcoin wallets.

Private key

A private key is used to secure access to Bitcoin wallets. Every wallet has a passcode, and when users forget or misplace them, the coins are lost forever.

Public address

You can call this the email address of cryptocurrency. It is usually 34 characters mixed with small letters, capital letters, and numbers.

Let’s wrap up

Some cryptocurrencies are here to stay. The market is massive, profitable, and at the same time, risky. In trading and earning Bitcoins, it is essential to follow legal sources, so you don’t get defrauded.

By Andrej Kovacevic

Updated on 22nd July 2020