Cryptocurrency investors seem increasingly confident that Donald Trump, the Republican candidate, will win the upcoming U.S. presidential election in November. According to a recent Bloomberg analysis, Bitcoin’s bullish trend appears closely tied to political expectations among investors.

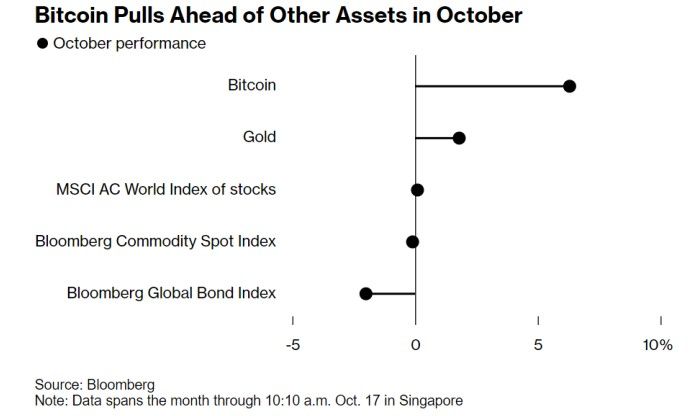

Despite a brief pullback, Bitcoin (BTC) has posted a significant 12% gain over the past week, as reported by CoinMarketCap. Experts cited in the report argue that Trump’s policies favor Bitcoin, pushing capital flows into cryptocurrencies and industries connected to his profile.

Prominent investor Stan Druckenmiller is among those who view the recent rise in cryptocurrency prices as a sign that markets are already factoring in a potential Trump victory.

Some analysts point out that Trump’s pledge to create clear regulations for the crypto sector is fueling investor optimism. Additionally, Trump’s personal investments in crypto suggest that fulfilling these promises could benefit his own portfolio.

Is Bitcoin’s Growth Tied to Trump’s Political Fate?

While Bitcoin’s current upward trend may align with electoral expectations, claiming a direct dependency would be an overstatement. Bitcoin, as a decentralized asset, isn’t solely influenced by political events, and its long-term trajectory remains driven by broader market dynamics.

The current environment reflects a time when external factors, like elections, can sway Bitcoin’s price movement, but they don’t fundamentally alter its core characteristics. Betting platforms such as Polymarket show Trump leading with 60.1% of wagers, compared to 39.9% favoring Kamala Harris.

Similarly, on PredictIT, Trump holds a slight edge over Harris, with a 55% to 48% preference. These betting trends indicate that crypto investors are already factoring in a potentially favorable outcome for Trump in the elections.

However, it’s essential to note that betting platforms do not guarantee election results. Polls indicate a tighter race between the candidates.

In the stock market, large capital inflows into Bitcoin spot ETFs also reflect growing confidence in crypto, driven by the prospect of a Trump victory. According to Farside, $1.385 billion flowed into these products from Monday to Wednesday.

By Andrej Kovacevic

Updated on 9th March 2025