One of the most anticipated macroeconomic figures of the week, the U.S. job openings data for July, was released this Wednesday. The results are less than encouraging, showing a continued cooling trend in the country’s labor market. Moreover, layoffs have increased, highlighting a significant drop in demand for workers. In this article, we’ll examine how Bitcoin might respond to these job market shifts.

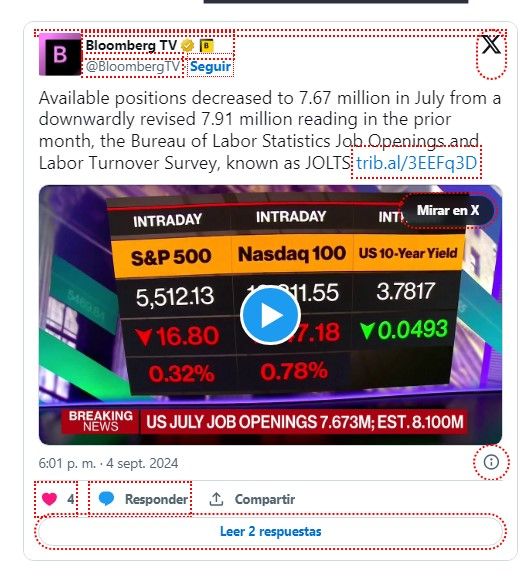

By Wednesday afternoon (Eastern Time), the U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey, commonly known as JOLTS. For July, the number of job openings fell below analysts’ expectations, fueling fears of a potential recession. It’s worth noting that July’s job openings were the lowest since January 2021.

How Could Bitcoin React to the JOLTS Data?

In July, job openings in the U.S. amounted to 7.67 million, marking a significant decline from June’s revised figure of 7.91 million. This latest number also falls well short of Wall Street’s estimates.

Experts had anticipated 8.1 million job openings, but the reported figures reveal that the employment sector is cooling at a faster pace than expected. Simultaneously, unemployment is rising, signaling that those seeking work are facing more difficulty in securing employment compared to previous months.

This trend is becoming more pronounced and could potentially lead to a recession in the world’s largest economy. Such a scenario has raised concerns among Federal Reserve officials, who will meet on September 17th and 18th to discuss their next policy moves.

The job data, combined with the manufacturing PMI report released the previous day, has all but forced the Fed to consider cutting interest rates. Should this occur, Bitcoin’s reaction is expected to be positive. However, it’s important not to take this for granted, as unforeseen circumstances could arise from the Fed’s decisions.

Possible Scenarios for Bitcoin After Interest Rate Cuts

It would be overly simplistic to assume that a rate cut would automatically lead to a Bitcoin rally. The reality is much more complex than the cause-and-effect relationship some analyses suggest. This is due to the potential side effects of such rate cuts on the U.S. economy.

Firstly, if the rate cut in September is too mild (or not implemented at all), the likelihood of a recession will increase. This is because the underlying conditions causing the cooling labor market wouldn’t change significantly. On the other hand, a drastic rate hike, while seemingly a solution, could also introduce new challenges.

For instance, a rate cut could lead to a balancing effect with China’s central bank rate. As a result, a significant portion of Chinese capital invested in dollar-denominated assets would return to China. Analysts estimate that this capital repatriation could amount to $1 trillion.

This scenario would cause the U.S. dollar to fall by as much as 10% against the yuan. Under such circumstances, the expected benefits of a weak dollar for risk assets like Bitcoin might not materialize. Thus, Bitcoin’s reaction could be negative in either an aggressive or a passive Fed response.

Crypto Market Welcomes JOLTS Report Positively

Despite the hypothetical negative scenarios outlined above, the overwhelming consensus is that a rate cut would benefit the markets. This explains why the JOLTS report, which pressures the Fed to lower rates, has been received positively by crypto investors, at least for now.

At the time of writing, major digital currencies are recovering, with BTC once again surpassing the $58,000 mark. It’s important to keep in mind that a rate cut in September would likely have better effects than maintaining the current rate. That said, a Bitcoin rally is not guaranteed.

By Andrej Kovacevic

Updated on 10th March 2025