The journey to success in Bitcoin starts with deep reading and thorough research. Don’t settle for shallow information. Analyze the data, study the projects, and understand the technological foundations that support this cryptocurrency. Information is power, and those who master it make better decisions. Keep reading to stay ahead.

How Much Bitcoin from Mt. Gox is Left to Repay?

The Mt. Gox exchange, infamous for its collapse in 2014 due to a massive hack, continues to cast a shadow over the crypto market. Creditors have been waiting for years to recover their lost funds.

Now, after prolonged legal battles and compensation procedures, Mt. Gox is finally prepared to distribute the remaining Bitcoins to its creditors. This distribution could lead many creditors to sell their Bitcoins, increasing selling pressure on the market.

According to a recent analysis by Arkham Intelligence, less than 25% of the original Mt. Gox Bitcoin remains to be distributed. This suggests that the repayment process is nearing its end and the feared market crash due to a massive sell-off of these funds is becoming less likely.

Interestingly, a survey of creditors shows that the majority (55%) do not intend to sell their Bitcoins, while others plan to sell only a small portion. These findings indicate that the impact on the market may be limited, as most of the funds will remain with the creditors.

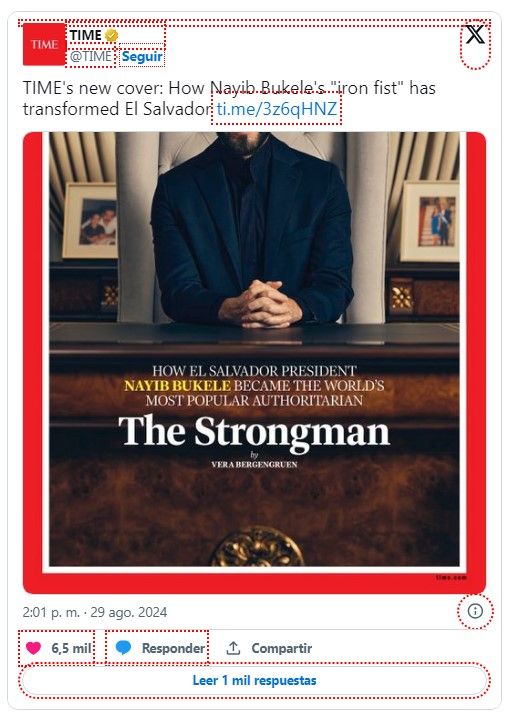

Bukele in TIME: Bitcoin’s Radical Gamble for El Salvador’s Future

In a revealing interview covering his ideology, the state of emergency, and the possibility of a second re-election, the American magazine TIME featured the Salvadoran President Nayib Bukele on its August 29 cover with the headline: “The Strongman: How El Salvador’s President Nayib Bukele Became the World’s Most Famous Authoritarian.”

In the interview, Bukele stated that making Bitcoin legal tender in the country was like offering Salvadorans another option while leaving them free to choose. “I won’t say it’s the currency of the future, but there’s a lot of future in this currency.”

Bukele also expressed that Bitcoin adoption has been a “net positive” for El Salvador, though he admitted it hasn’t delivered as many benefits as he had anticipated.

In terms of gains, he stated that as a government, El Salvador has invested $135 million in Bitcoin and now holds $400 million in Bitcoin in the public wallet. Regardless, Bukele is satisfied with the impact his Bitcoin strategy has had on El Salvador.

BlackRock Adds 4,000 Bitcoin ETF Shares, Holdings Increase to 16,000

BlackRock recently made headlines in the crypto ecosystem after acquiring 4,000 Bitcoin ETF (IBIT) shares for its Strategic Global Bond Fund (WAMIX), bringing the total holdings to 16,000 shares. This represents a 33% increase compared to the previous month and positions the fund as one of the most “crypto” institutional funds today.

This decision to add BTC to its global bond fund clearly indicates that BlackRock views Bitcoin as a valuable and strategic component within its investment offerings.

Interestingly, BlackRock now surpasses Grayscale in cryptocurrency holdings. The former holds $22.14 billion in crypto assets, while the latter has $21.99 billion in crypto holdings.

Analyst: Bitcoin Could Reach $150,000

According to crypto analyst Jamie Coutts, Bitcoin’s price is progressively entering the parabolic phase of the macroeconomic bull run, similar to previous cycles. He specifically highlighted that all indicators point to a significant rally before the end of the year, which could push Bitcoin’s price toward $150,000.

He stated, “Unless something has fundamentally changed, we are entering what Raoul Pal calls the ‘banana zone,’ or what I would describe as Bitcoin’s madness season. With Bitcoin’s recent price surge, nearing the $63,000 mark, many financial firms are looking to capitalize on the market’s potential.”

Furthermore, he noted that Bitcoin’s price action, in its four-year cycle, tends to recover at a decreasing factor whenever the US dollar index falls into a bearish trend.

Michael Saylor: MicroStrategy Grew 1113% in 4 Years Thanks to “Bitcoin Standard”

Finally, Bitcoin enthusiast and MicroStrategy co-founder Michael Saylor affirmed Bitcoin’s potential, commenting on its continuous promise and growth: “Four years later, on the Bitcoin standard, you would have outperformed every company in the S&P 500.”

According to a chart shared by Saylor, MicroStrategy grew by 1113% in just four years, surpassing the growth of every company in the S&P 500, including major players like Nvidia. Despite short-term fluctuations, MicroStrategy’s commitment to Bitcoin has paid off.

While MicroStrategy is not yet part of the S&P 500, it is close to achieving this. By adjusting its accounting practices, the company could report significant profits and join this select group. This inclusion would be a major milestone for the crypto market, as it would cement Bitcoin’s position as an attractive asset for institutional investors.

I’ll leave you with this quote from Cathie Wood: “I see Bitcoin as a store of value superior to gold in the long term.”

By Andrej Kovacevic

Updated on 31st August 2024