A post on X by financier Michael Saylor highlights the rapid growth of MicroStrategy over the past four years:

“Four years later, under the Bitcoin standard, you would have outperformed every company in the S&P 500,” the financier stated in the post.

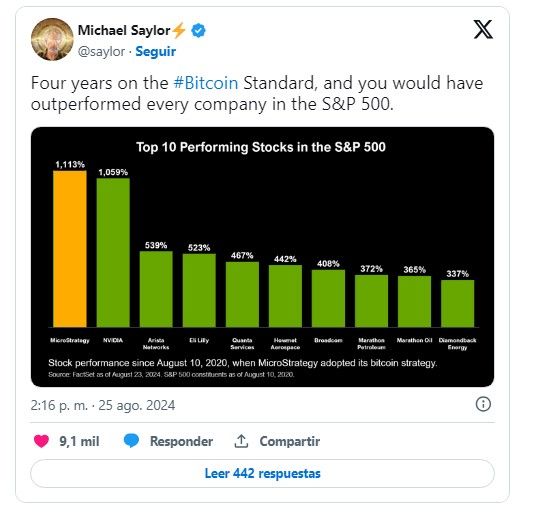

According to the chart shared by Saylor, MicroStrategy grew by 1113% in just four years, outpacing all companies in the S&P 500 index, including major players like Nvidia.

The S&P 500 index is one of the most important in the United States and is considered the most representative of the country. This index is based on the market capitalization of 500 companies listed on the NYSE or NASDAQ. Therefore, Saylor’s figures show MicroStrategy’s growth surpassing 500 companies.

It’s worth noting that MicroStrategy (MSTR) is not part of the S&P 500. However, the company is close to meeting the necessary criteria for inclusion. If it adopts new accounting rules, it could report significant profits and qualify for this index.

Returning to the chart shared by Saylor, Nvidia ranks second with a remarkable 1059% growth, driven by the rise of artificial intelligence. This growth has made Nvidia the second most valuable technology company in the world, above Microsoft and Alphabet (Google), and just below Apple.

The Returns of the “Bitcoin Standard”

While it’s not the first time a company has achieved such returns, it is noteworthy that MicroStrategy has done so in a completely different way than any other company. For instance, Nvidia has benefited from the massive growth in the artificial intelligence sector and its sale of specialized chips.

Remember, Nvidia is one of the leaders in the sale of specialized chips for artificial intelligence (AI). Its GPUs, such as the Nvidia A100 and H100, are widely used in AI applications and high-performance computing.

In contrast, MicroStrategy began purchasing BTC four years ago, motivated by predictions of six-figure prices for the cryptocurrency in the coming years. By adopting the “Bitcoin Standard,” its performance has surpassed all S&P 500 companies.

The Bitcoin standard refers to the exposure to Bitcoin that the company has adopted as a strategy. This, in turn, allows investors to use the company’s shares to trade with Bitcoin prices.

However, MicroStrategy’s growth could continue, and that’s why some analysts, such as Cantor Fitzgerald (a financial services firm), predict that the price of MicroStrategy shares (MSTR) could reach up to $194.

In addition to the growth in capitalization, MicroStrategy has achieved several legal milestones that have allowed it to diversify its product portfolio. For example, at the beginning of this year, MicroStrategy shares (MSTR) were added to the MSCI World Index.

Growth of S&P 500 Companies

Despite the sharp rise in MicroStrategy’s stock price, other companies within this index, such as Arista Networks, a company specializing in solutions designed for large data centers and high-performance environments, experienced significant growth of 539%. Like Nvidia, Arista Networks benefited from the demand for AI-focused hardware.

Meanwhile, Eli Lilly and Company, a U.S.-based pharmaceutical company founded in 1876, saw an increase of 523%. Other companies on the list, such as Quanta Services (467% growth), Howmet Aerospace (442% growth), Broadcom (408%), and Marathon Petroleum (372%), also showed excellent returns.

By Andrej Kovacevic

Updated on 27th August 2024