Mt. Gox Moves 140,000 Bitcoin in Just 3 Hours

According to CoinMarketCap, Bitcoin‘s price surged to $64,900 this morning before plummeting to $62,500. This sharp decline is attributed to the massive movements by the Mt. Gox exchange.

Within a span of just 3 hours, Mt. Gox, which is currently engaged in reimbursing funds to its creditors, moved approximately 140,000 bitcoins worth nearly $9 billion.

These transactions were initiated from a cold wallet to unknown addresses.

Notably, Arkham Insight reports that Mt. Gox still holds 138,985 BTC and has started mobilizing these funds for the first time in two weeks.

The most notable transactions involved 47,200 and 48,600 BTC, sparking nervousness in the market.

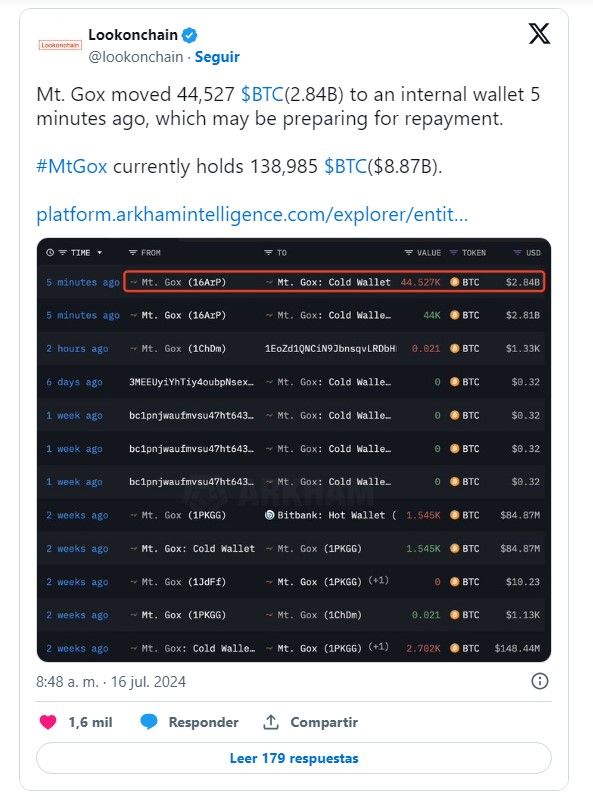

Another significant transfer involved 44,525 BTC to an internal wallet, possibly preparing for disbursement.

“Mt. Gox moved 44,527 BTC ($2.84 B) to an internal wallet 5 minutes ago, potentially preparing for repayment. Mt. Gox currently holds 138,985 BTC ($8.87 B).”

In total, the combined transaction volume of Mt. Gox reached 190,000 BTC, equivalent to approximately $12 billion, within just 3 hours.

Key Points to Consider

Another crucial point to consider is that Kraken is among the first exchanges selected for fund disbursement.

Kraken has stated that the redistribution of BTC and BCH will occur within the next 14 days. This information was conveyed via an email from the exchange itself.

Additionally, on July 5th, Mt. Gox released documents showing that disbursements have already begun through some exchanges, although the time frame varies for each. For instance:

- Kraken will distribute BTC to creditors within the next 90 days.

- Bitstamp will complete its distributions within 60 days.

- BitGo within 20 days.

- SBI VC Exchange and Bitbank within 14 days.

Creditors had the option to receive their funds in either cash or cryptocurrency. Those who chose cryptocurrencies will get their reimbursement between July 1st and October 31st.

Will Bitcoin’s Price Decline Further?

At the time of writing, Bitcoin’s price is $64,500, having dropped from a high of nearly $65,000 to $62,500. Currently, the digital asset is recovering from this drop.

Some analysts believe that the price declines caused by the disbursements could provide favorable entry points, anticipating a subsequent price recovery.

An analyst on X named ZachXBT commented: “Like the German transfers, these movements will eventually have no impact on the price. That’s when I plan to go long.”

It’s important to note that many creditors might be looking to sell their BTC, which could result in greater bearish pressure compared to the German government’s sales.

Financial analyst Jacob Lord predicts that up to 100% of Mt. Gox creditors might seek to sell their BTC once they gain possession.

By Andrej Kovacevic

Updated on 18th July 2024