Influential investor, author, and analyst Robert Kiyosaki has once again warned of an impending financial collapse, which he claims will be the largest in history. According to Kiyosaki, all markets, including crypto, are headed for a significant downturn due to misguided macroeconomic policies in the United States.

A few months ago, Kiyosaki predicted that all financial markets were inevitably moving toward a crash. At that time, he emphasized that even assets like Bitcoin, gold, silver, bonds, stocks, and real estate would see drastic declines.

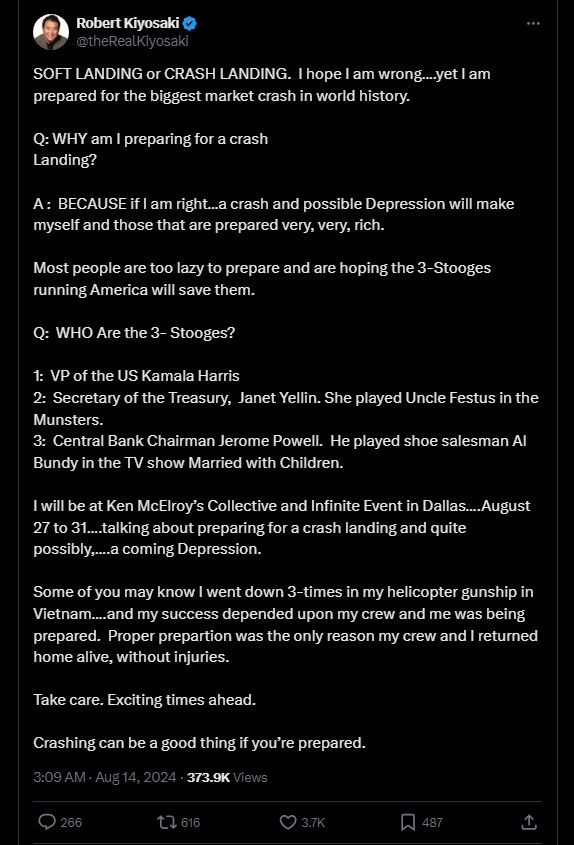

In a recent post on X (formerly Twitter), the author of “Rich Dad Poor Dad” doubled down on his grim outlook for all markets. Kiyosaki points to what he calls “the three stooges” as the main culprits behind this potential catastrophe. This term refers to U.S. Vice President Kamala Harris, Treasury Secretary Janet Yellen, and Federal Reserve Chairman Jerome Powell.

Despite his pessimistic view, Kiyosaki asserts that crises also present opportunities. He urges people to be prepared to capitalize on the downturns and create wealth during these challenging times.

Is a Crypto Market Crash Inevitable?

Kiyosaki firmly believes that a market crash is on the horizon. However, some of his predictions seem exaggerated, particularly regarding Bitcoin. For instance, a potential victory by Donald Trump in the upcoming elections could dramatically alter the landscape.

In that scenario, new regulations and policies might accelerate the widespread adoption of Bitcoin in the U.S. Given Bitcoin’s capped supply of 21 million coins, its price trajectory could take a completely different path from the one Kiyosaki anticipates.

It’s important to note that Kiyosaki acknowledges the possibility of being wrong and hopes that this is the case. Nonetheless, he continues to advise people to prepare, expressing concern that many are relying on “the three stooges” to save them.

Following the significant downturn, Kiyosaki predicts a robust recovery in reserve assets. He projects that gold could reach $15,000 per ounce, silver $110 per ounce, and Bitcoin could soar to $10 million per coin.

According to the expert, being prepared means consistently investing in these three assets and exercising patience.

By Andrej Kovacevic

Updated on 15th August 2024