Recent data from DefiLlama reveals a significant drop in trading volume on Solana’s decentralized exchanges (DEX) over the past week, with a decline of more than 10%. In contrast, trading volumes on Ethereum, Base, and Sui DEXs have seen increases of 12%, 11%, and a notable 77%, respectively, during the same period.

To put this into perspective, Ethereum led in terms of trading volume in USD over the past week, amassing $16.5 billion. Solana‘s DEX activity secured the second spot with just over $11 billion, while Base’s DEX trading volume totaled $5.4 billion during the same period.

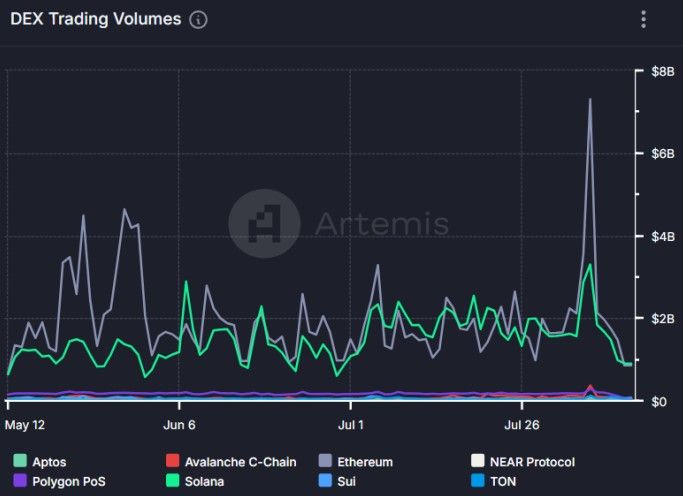

Additionally, data from the platform Artemis shows that daily trading volumes on Solana’s DEXs have plummeted by as much as 72%. On Sunday, Solana’s DEX volume was approximately $897 million, marking the lowest single-day volume on the network since June 30 of this year.

However, it’s essential to highlight that Ethereum still holds a substantial advantage over Solana in terms of total value locked (TVL) on DEXs, with Ethereum’s TVL surpassing $6.44 billion compared to Solana’s $1.74 billion.

Experts suggest that the reduction in Solana’s DEX volume is closely linked to a more than 19% decrease in blockchain activity over the past week. This decline indicates lower user participation, exposing the SOL token to the risk of price volatility in either direction.

Solana: Between Institutional Adoption and Market Uncertainty

Despite the drop in trading volume on Solana’s blockchain, Tristan Frizza, the founder of the DeFi platform Zeta Markets, emphasized that Solana’s network still accounts for nearly 10% of the entire DEX market.

In a recent interview, Frizza referenced data from a CoinShares research note, which indicates that institutional investors have been increasing their exposure to Bitcoin and altcoins, with Solana experiencing a “surge in allocations.” Frizza also noted that as institutional adoption grows, it could bring an “influx of capital” into Solana’s ecosystem, driving innovation and demand for the SOL token.

“However, the future pace of institutional DeFi adoption on Solana will depend on general economic conditions and regulatory developments,” Frizza stated during the interview.

Moreover, readings from the Chaikin Money Flow (CMF) indicator suggest indecision in the SOL crypto market. As both buyers and sellers start to pull back on trading activities, Solana’s CMF currently sits at its focal line of 0, according to CoinMarketCap data.

It’s important to note that a CMF reading near zero reflects weak momentum in either direction, indicating no clear dominance in buying or selling activity, and suggesting that Solana’s market may be consolidating.

By Andrej Kovacevic

Updated on 13th August 2024