If you engage in cryptocurrency transactions that result in sales or earnings throughout the year, you’ll likely need to include this income in your tax filings. Navigating taxes can be daunting, but specialized crypto tax software can alleviate much of the complexity. In this guide, we highlight some of the best crypto tax software available. Let’s dive in.

Best Crypto Tax Software

1. ZenLedger

ZenLedger stands out as top-tier crypto tax software, assisting users in tracking their cryptocurrency investments and tax obligations. It provides real-time updates on your digital currency portfolio and helps calculate the taxes owed on your profits.

The software is designed to be user-friendly, even for those not familiar with accounting or tax laws. It integrates with multiple cryptocurrency exchanges and wallets, where you store your coins. Additionally, ZenLedger works seamlessly with popular accounting software like TurboTax, simplifying the tax preparation process.

Whether you’re an individual investor or a tax professional, ZenLedger ensures accurate reporting of your cryptocurrency gains and the right tax payments. It’s a valuable tool for managing digital currency investments and staying compliant with tax obligations.

Pros:

- Provides accurate and up-to-date tax reports

- Supports connectivity with numerous exchanges

- Features an intuitive interface

Cons:

- Additional fees required for DeFi support

- Limited capabilities on the free plan

Only offers US tax form downloads

TurboTax Premium is a top choice for crypto tax software in 2024, coming from a well-known tax preparation company. It excels in reporting crypto transactions and handling complex tax scenarios overall. The software features intuitive navigation, comprehensive tool tips, FAQs, and excellent customer support, including access to tax experts for additional assistance. Notably, TurboTax Premium allows users to file their entire tax returns directly through the platform.

Pros:

- Imports crypto sales directly into the software for convenience

- Enables filing of your entire tax return directly, a unique feature among crypto tax products

Cons:

Crypto-related functions are exclusive to TurboTax filers

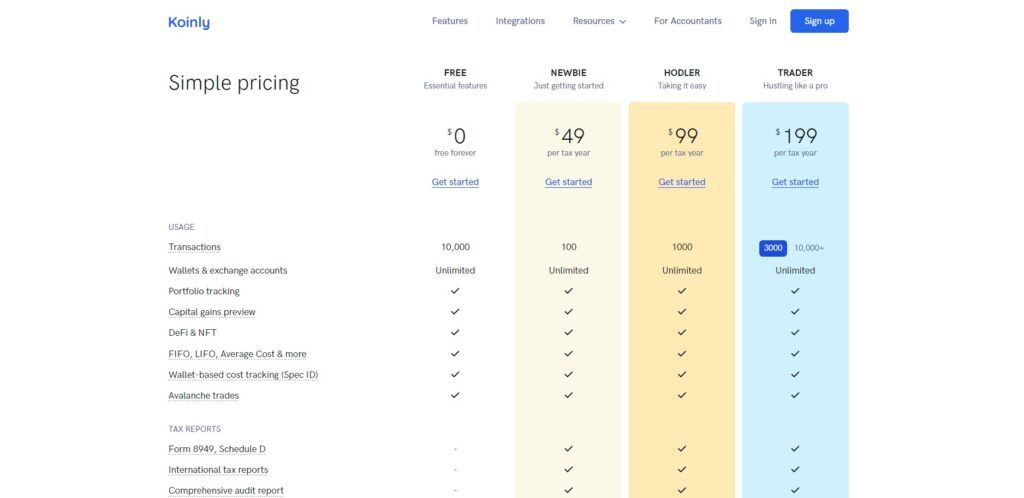

3. Koinly

Koinly offers a user-friendly interface that simplifies managing crypto tax obligations. It supports easy integration of various crypto accounts, providing a clear overview of your activity throughout the year. Koinly also distinguishes itself with responsive customer support via live chat and email. However, it should be noted that its security measures, limited to SSL technology, are more basic compared to some competitors offering additional layers of protection like two-factor authentication.

Choosing the right crypto tax software can significantly streamline your tax reporting process, ensuring compliance and potentially maximizing your deductions.

Pros:

- Features intuitive navigation and a straightforward interface

- Enables continuous tracking of all cryptocurrency accounts

- Offers a free trial to begin preparing tax reports

Cons:

- Requires payment to download finalized crypto tax forms

Security features are less robust compared to competitors

4. CoinTracker

CoinTracker is an excellent option for managing your cryptocurrency taxes with robust customer support.

They offer help through email and are working on adding live chat soon. CoinTracker can also connect you with a crypto expert who can assist with your entire tax return and provide legal tax advice. While the first consultation is usually free, there may be a fee if you decide to hire a CoinTracker professional.

The platform is designed to help you manage all your different crypto wallets in one place. CoinTracker updates your portfolio automatically, so you can easily see how your investments are doing and keep track of all your transactions.

One downside is that if you use the free version of CoinTracker, which is available for users with 10,000 transactions or less, you won’t get tax reports.

Pros:

- Provides customer support via email with response times typically ranging from one to two days. A live chat feature is expected in the future

- Offers access to “vetted crypto experts” who can assist with completing full tax returns and offer legal tax advice

Cons:

- Connecting with a CoinTracker tax professional starts at $500

- The free version of CoinTracker does not include tax reports

Final Thoughts

Crypto tax software simplifies the reporting and management of taxes on your cryptocurrency investments. It helps track transactions, calculates tax owed, and ensures compliance with tax regulations. Choosing the right software depends on ease of use, support for various exchanges and tax forms, and data security measures. Utilizing crypto tax software can save time and ensure accurate handling of digital investments at tax time.

By Andrej Kovacevic

Updated on 18th July 2024