As Donald Trump reclaims the presidency, the landscape for cryptocurrency companies eyeing stock market listings may be transforming. ARK Contribute, a leading asset management firm led by Cathie Wood, suggests that Trump’s leadership could reshape the SEC, potentially paving the way for Initial Public Offerings (IPOs) in the cryptocurrency industry.

Plain Bringing Down, ARK Contribute’s chief of research, pointed out that with Bitcoin reaching record highs, the new administration may deliver the regulatory clarity long-awaited by digital asset companies. This shift could be pivotal for firms like Circle and Kraken, which have expressed strong interest in launching IPOs of their own.

Furthermore, a Republican majority in Congress could accelerate the passage of essential legislation, such as the Financial Innovation and Technology for the 21st Century Act (FIT21) and the 2023 Stablecoin Clarity Act. These initiatives aim to establish a well-defined regulatory framework, delineating the roles of the SEC and the CFTC, which would be a major boost for crypto enterprises seeking growth within the U.S. market.

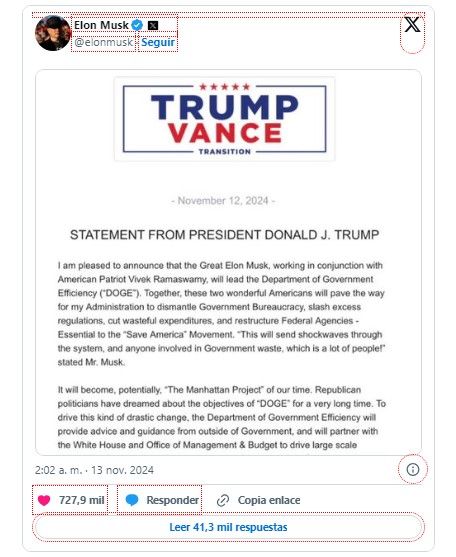

Trump Appoints Musk and Ramaswamy to Lead New Government Efficiency Department

In a bold move, President-elect Donald Trump has announced the creation of the Department of Government Efficiency (DOGE), a groundbreaking body dedicated to cutting government spending and eliminating excessive regulation. Appointed to lead DOGE are high-profile entrepreneur Elon Musk and business leader Vivek Ramaswamy, both bringing their industry expertise to streamline federal agencies and slash bureaucracy.

DOGE’s mission is vast: targeting the $6.5 trillion in annual government spending, identifying wasteful areas, and pursuing large-scale reforms in coordination with the White House and the Office of Management and Budget. Musk shared his enthusiasm on X, stating that this initiative would “shake up the system” and offer substantial financial relief to taxpayers.

Cardano Foundation Reports $478 Million in Assets for 2023, Focuses on Adoption, Education, and Resilience

The Cardano Foundation, committed to advancing the open-source blockchain ecosystem, disclosed a 2023 asset base totaling $478 million. Their Financial Outlook Report outlined a strategic focus on three pillars: education, adoption, and operational resilience.

According to the report, 82.5% of their funds are held in ADA (Cardano’s cryptocurrency), while 10.1% are in Bitcoin, signaling a dedicated belief in the blockchain ecosystem. A sum of $19.22 million was allocated to their primary initiatives, with $12.92 million dedicated to advancing Cardano adoption, including initiatives aimed at enabling institutional use of the Cardano network. Additionally, $4.18 million was funneled into educational programs, such as the Cardano Institute and the prominent Cardano Summit held in Dubai. Lastly, $2.12 million went towards operational resilience, securing more than 2,000 days of uninterrupted network activity.

Frederik Gregaard, CEO of the Cardano Foundation, reaffirmed the organization’s commitment to transparency, emphasizing their role in cultivating a trustworthy, accessible blockchain ecosystem.

Trump Chooses Bitcoin Advocate Pete Hegseth as Secretary of Defense

In another groundbreaking decision, Trump has nominated Pete Hegseth—Fox and Friends Weekend co-host and Army veteran—as the new Secretary of Defense. Hegseth, a prominent supporter of Bitcoin, has frequently voiced his endorsement of cryptocurrencies, citing their potential in a less government-controlled environment.

Following Trump’s victory, Hegseth shared on Fox Business that the incoming administration would likely ease cryptocurrency regulations, fostering a more open market environment. “Look at Trump, making Bitcoin great again,” he remarked. Bitcoin surged to a record high of over $90,000, fueled by the market’s confidence in a pro-crypto administration.

By Andrej Kovacevic

Updated on 9th March 2025