This Friday, the US employment data for September was released, and it brought great news for equity investors. The job gains in the month far exceeded expectations, which in turn triggered a rise in Bitcoin during the early hours of the trading day.

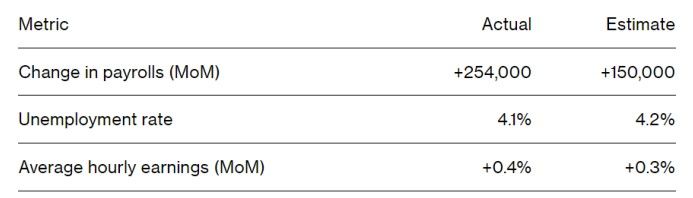

In September, non-farm payrolls saw a total increase of 254,000 jobs, a significant jump from the 150,000 expected. This surge in demand for new workers across key sectors of the economy is one of the most robust seen in 2024, according to Bloomberg. Another notable detail from the Bureau of Labor Statistics’ announcement is the drop in the unemployment rate to 4.1%, down from the expected 4.2%.

Meanwhile, the average hourly wage grew by 0.4%, surpassing the forecast of 0.3%. This collection of positive data clears up doubts surrounding the anticipated soft landing sought by the Federal Reserve. Simply put, it appears the Fed is managing to control inflation while keeping the economy in expansion, which is a rare accomplishment in economic history.

These positive indicators have a bullish impact not only on stocks but also on cryptocurrencies. As of this writing, although investors are still digesting the news, Bitcoin’s price has already responded with an upward movement.

Macro Data Boost Bitcoin Price

As expected, this data injects a wave of optimism into risk markets. At the time of writing, major US stock indices are showing green numbers. The S&P 500 is up 0.15%, while the Nasdaq has gained nearly 0.6%. Meanwhile, 10-year Treasury bond yields have dropped by 0.86%.

Specifically, Bitcoin, the largest cryptocurrency, is up 2.51% over the past 24 hours. Its price is approaching $62,000 per coin, following a sharp decline in recent sessions. Despite this recent rise, the weekly performance remains negative.

Other alternative digital currencies are also moving into the green over the last 24 hours. However, gains among major tokens are modest at this early stage. On the other hand, in the memecoin market, assets like Shiba Inu have shown more dynamic growth, with Shiba Inu rising by 11%, making it one of the top performers in the top 20.

As previously mentioned, the positive sentiment may continue to lift Bitcoin in the coming hours, as macroeconomic factors fuel its climb. Despite the optimistic outlook, there are still factors that could apply bearish pressure on the market.

Awaiting Israel’s Response to Iran

Recently, Iran launched a large-scale missile strike against Israel in retaliation for recent Israeli attacks on Lebanon. Both Israeli and US authorities have made it clear they will not stand idle and will issue a strong response.

In turn, Tehran warned that any retaliation from Israel would trigger an even more extensive missile assault from Iran. Experts suggest that Israel may be planning to strike Iranian oil and nuclear infrastructures, which would mark a major escalation in the conflict. It is important to note that, so far, Iran has limited its attacks to Israeli military targets.

Tensions in the region are still unfolding. A full-scale war between the two nations could cause a significant market crash. Keep in mind that the Middle East is a vital player in maintaining global economic stability.

Thus, Bitcoin’s limited reaction to Friday’s macroeconomic data may be connected to ongoing geopolitical tensions.

By Andrej Kovacevic

Updated on 9th March 2025