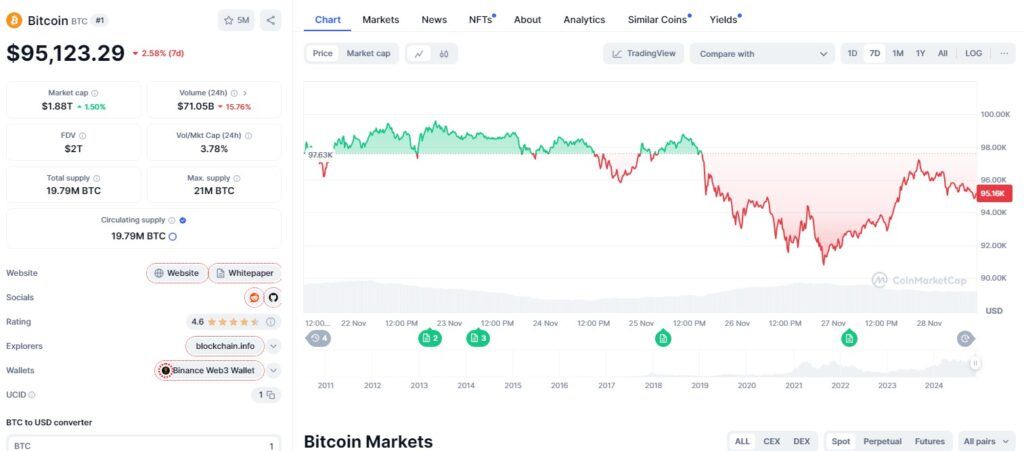

The Bitcoin market continues to captivate global attention as the cryptocurrency trades around $95,300, following its all-time high of $99,700 on November 22. With a market capitalization of $1.88 trillion, Bitcoin maintains its position as the undisputed leader in the crypto world.

However, trading volume has dropped 22% in the past 24 hours, settling at $70.95 billion. Against this backdrop, the Thanksgiving holiday in the United States could bring unique dynamics to the market.

What Is Thanksgiving Day?

Thanksgiving is one of the most celebrated holidays in the United States, observed on the fourth Thursday of November. Families and friends come together to reflect on their blessings and accomplishments over the year while enjoying traditional dishes like turkey, mashed potatoes, and pumpkin pie.

Beyond its historical roots, Thanksgiving marks the beginning of the holiday shopping season, with events like Black Friday and Cyber Monday driving consumer activity.

In the financial world, Thanksgiving typically results in reduced activity due to the national holiday. However, the crypto market operates 24/7, ensuring that Bitcoin trading remains active, even on festive days.

Bitcoin’s Short-Term Outlook

Bitcoin has shown remarkable strength, yet its failure to break the psychological barrier of $100,000 could lead to short-term corrections. Analysts highlight two key factors likely to influence Bitcoin’s performance in the coming days:

- Key Technical Levels:

- Support Level: $91,500. This level could act as a rebound point if prices dip.

- Resistance Level: $99,700, the recent high. Surpassing this level would be crucial for Bitcoin to target the $100,000 milestone.

- Market Sentiment:

The holiday season might spur speculative activity as retail investors become more active. However, the drop in trading volume suggests that major price movements may be limited.

Image Credit: coinmarketcap

Macroeconomic Factors

The broader sentiment around Bitcoin continues to benefit from expectations of crypto-friendly policies under Donald Trump’s administration and optimism about regulatory developments in the United States. These factors bolster long-term confidence in Bitcoin, even as short-term volatility persists.

Conclusion

Bitcoin enters Thanksgiving at a pivotal moment, with the $100,000 milestone within reach. While traditional markets remain closed, the crypto space could see heightened volatility. For investors, this is an opportune time to reassess short-term strategies and closely monitor any movements that could signal the next phase for the world’s leading digital asset.

By Andrej Kovacevic

Updated on 9th March 2025