After contending with relentless selling pressure from the Grayscale Bitcoin Trust ETF (GBTC), the combined liquidations of approximately 60,000 BTC by the German and U.S. governments, distributions to Mt Gox creditors amounting to over 100,000 BTC, and additional distributions linked to the collapse of Celsius, Gemini, and Genesis Trading, Bitcoin is still holding steady at a $64,000 price level. As we approach October—historically the strongest month for Bitcoin—expectations of new all-time highs are reaching a fever pitch.

Bitcoin Bulls Have Absorbed Over 1.2 Million BTC in Selling Pressure So Far This Year

At the time of writing, Bitcoin is trading at $64,163. This resilience is particularly noteworthy when considering that the world’s largest cryptocurrency has had to absorb around 1.2 million BTC in selling pressure since the start of the year.

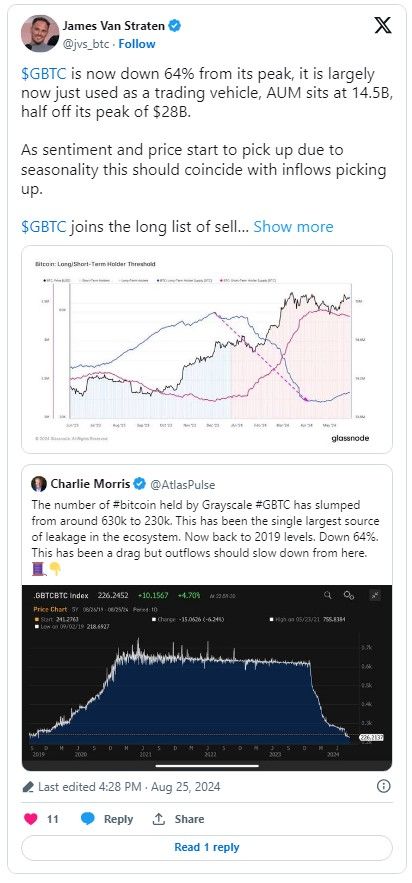

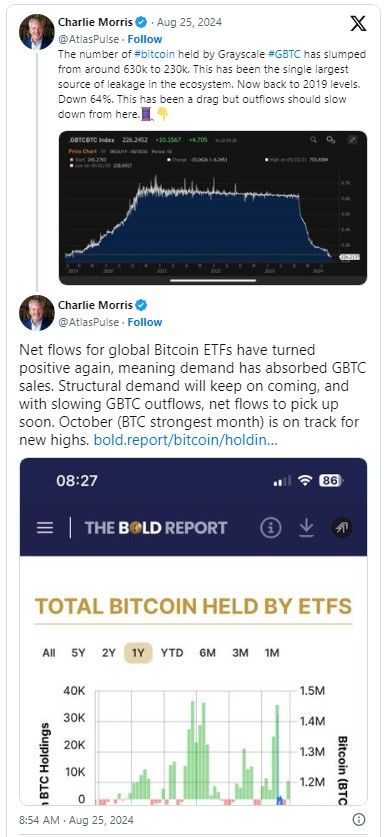

Moreover, most of the bearish influences on Bitcoin are now fading. The Grayscale Bitcoin Trust ETF has lost half of its holdings and no longer has the power to single-handedly dictate the cryptocurrency’s short-term price direction.

The coordinated liquidations by the German and U.S. governments have failed to dent Bitcoin’s medium-term bullish outlook. As of the end of July, the U.S. government still holds approximately 200,000 BTC. However, in what could be a pivotal moment for the crypto sector, former President Trump has pledged to use this reserve to establish a strategic Bitcoin reserve should he win the U.S. presidency again in November.

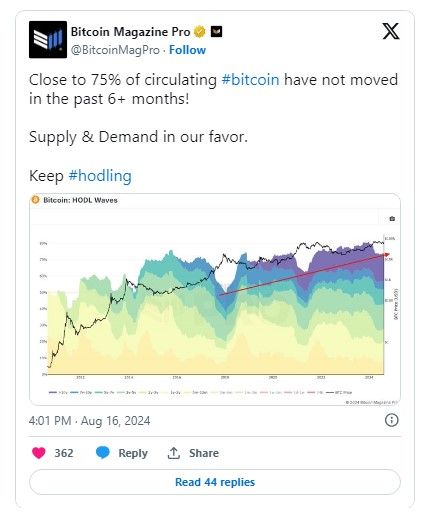

Finally, Mt Gox creditors, who recently received BTC payouts nearly a decade after the collapse of the crypto exchange, are remarkably still HODLing—holding on to their assets in anticipation of future gains.

Of course, spot Bitcoin ETFs, which now represent the most significant bullish influence on Bitcoin’s price trajectory, have played a crucial role in absorbing this combined selling pressure. These ETFs now hold nearly 1 million BTC, and institutional adoption of Bitcoin through these spot ETFs is accelerating.

When these factors are considered in the context of October’s approach, which has historically been the strongest month for Bitcoin, the conclusion is clear: new all-time highs are far more likely in the coming weeks than further weakness.

Lastly, it’s worth noting that Federal Reserve Chairman Jerome Powell recently stated that “the time has come for policy to adjust,” signaling a strong likelihood that the Fed will begin cutting the benchmark interest rate in September. Given Bitcoin’s sensitivity to global excess liquidity, this development will only add further momentum to the cryptocurrency’s bullish outlook.

By Andrej Kovacevic

Updated on 25th August 2024