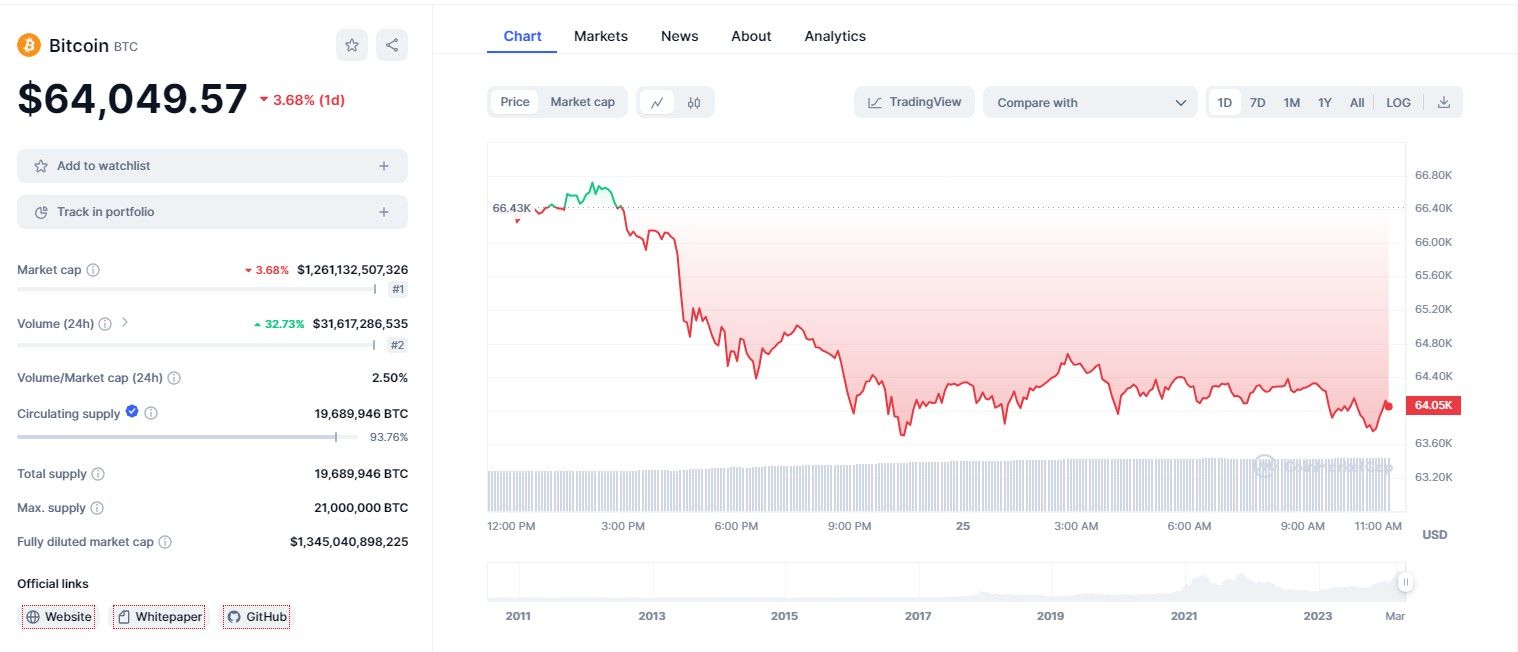

The cryptocurrency market cap has seen a decrease of approximately 4%, now standing at roughly $2.48 trillion. This decline is predominantly driven by Bitcoin, which was trading at around $64,253 early Thursday in the Asian markets, after struggling to breach the significant $67k resistance level.

More than $212 million in crypto assets were liquidated recently, largely affecting those in long positions due to heightened market volatility.

Exploring the Factors Behind Today’s Crypto Slump

The cryptocurrency sector, a market traded worldwide, is significantly shaped by a mix of speculative dynamics and major international developments.

Current State of the Market

Ali Martinez, a notable cryptocurrency analyst, signaled a bearish forecast on Wednesday. His observation of a sell indication via the TD Sequential on a 12-hour chart has led to caution among traders, especially as Bitcoin’s price slipped beneath the $65,500 support line.

Despite a recent halving event, Bitcoin whales appear to be pausing their asset accumulation, likely anticipating upcoming first-quarter earnings announcements from major companies in 2024.

Reduced Inflows to Spot BTC ETFs

The flow into U.S.-based spot Bitcoin ETFs turned negative on April 24, 2024, reaching a decrease of $121 million. Notably, BlackRock’s iShares Bitcoin Trust reported no new inflows for the first time ever, and Grayscale’s Bitcoin Trust saw a withdrawal of about $130.4 million.

BlackRock’s Clarification on Hedera

Amid intense speculation about BlackRock’s potential use of Hedera for tokenizing funds, the company clarified on Wednesday that it has no plans to form any commercial ties with Hedera, nor to tokenize any funds on its network. Following this news, the value of Hedera (HBAR) plummeted by as much as 35%, now trading at roughly $0.1135.

Uncertainties in the U.S. Economy

President Joe Jiden’s recent proposal to implement a 44.6% capital gains tax on crypto investments over $400k has added to market jitters. As the financial community anticipates next week’s FOMC statement and potential delays in interest rate adjustments, this has added another layer of speculation to the mix.

By Andrej Kovacevic

Updated on 14th July 2024