Back in 2008, the global economy suffered a huge blow due to a crisis in the American financial and housing markets. As the damage spread, it turned into a worldwide recession that shook everyone’s confidence in the traditional financial system. It was that loss of faith that became the impetus for the creation of Bitcoin. Now well-known, it was at the time intended to be a stateless replacement for the existing nation-led global currency system.

It was a bold vision, and it worked – somewhat. In recent years, Bitcoin has made people around the world billionaires almost overnight, but the technical limitations of the system made it a poor day-to-day replacement for fiat currency. It also touched off a period of innovation that would give rise to countless other cryptocurrencies, each with its own vision and purpose.

Today, there’s a thriving blockchain ecosystem featuring cryptocurrencies for every niche purpose imaginable. Notably, though, there haven’t been many cryptocurrencies aimed at providing investors with something resembling a structured, reliable, income stream. That all changed with the debut of Hex, which pays stakers a handsome dividend in exchange for their investment. But crypto-enthusiasts have been quick to label it a scam – believing its founder to be using it simply to generate massive gains for himself.

And yet, the idea of creating the crypto-equivalent of a certificate of deposit remained intriguing. And now, a new team has built a successor to Hex that they believe solves its biggest problems and more. It’s called Axion, and here’s a guide to how it works, what makes it different from Hex, and how you can get involved.

What is Axion?

Axion is a new cryptocurrency that’s aimed at investors who would like a crypto-powered investment vehicle that offers stable returns with less risk of precipitous losses. Axion does this by basing its prices on inflation – at an astounding 8% yearly inflation distributed to staked amounts, and by flipping the traditional cryptocurrency model on its head. That’s because it operates by paying rewards to holders of the currency that agree not to sell it for a defined period, rather than paying rewards to miners as traditional cryptocurrencies do.

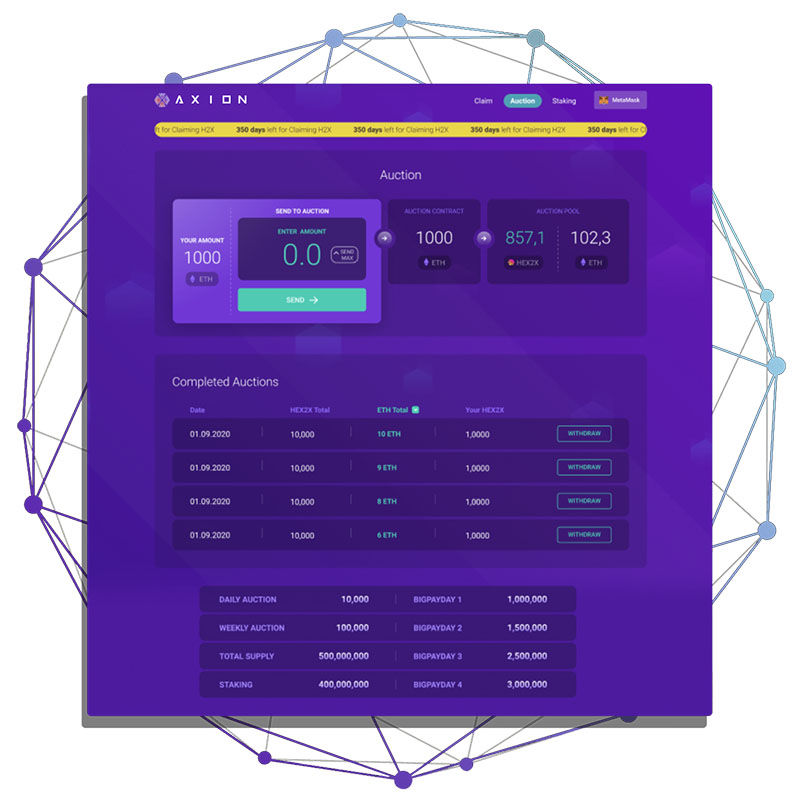

This has the effect of stabilizing the price of the coin because it prevents the volatility that comes with unpredictable sales. It also is part of the reason that Axion can pay investors such a high annual inflation rate. The other half of the gains come from auctions of Axion tokens. Tokens end up in auction as a result of penalties paid for early withdrawal, or when Hex holders (who are eligible to swap their tokens for Axion 1:1) fail to make timely claims. Upon deposit of Ethereum to the Auction, 80% of the proceeds are immediately used to purchase Axion from exchanges, thus increasing the price of the token.

How Axion Improves on Hex

The fact that Axion’s founder holds no tokens is a critical difference between it and Hex. With no personal stake, the founder can’t use Axion as a pump and dump scheme, which is one of the major fears many investors had about Hex. That’s not the only difference, though. Another improvement is the fact that a full 100% of the currency’s inflation is paid to stakers and 100% of all penalties are used to fund the daily auctions. The inflation payout incentivizes holders of the currency to stay invested for the long haul, which further discourages any attempt at outside price manipulation. The additional funding for auctions allows for more potential buybacks, circling back to the long term investing incentive.

How to Purchase Axion

If you’re interested in purchasing Axion to start your wealth-building, the process couldn’t be easier. It takes just four steps, and you’ll be all set to watch your investment grow. The steps are:

- Purchase Ethereum from whatever exchange you use for your crypto-purchases. Depending on how you fund your purchase, your Ethereum may or may not be immediately available for use. Once your transaction clears, you’ll be ready to move on to step two.

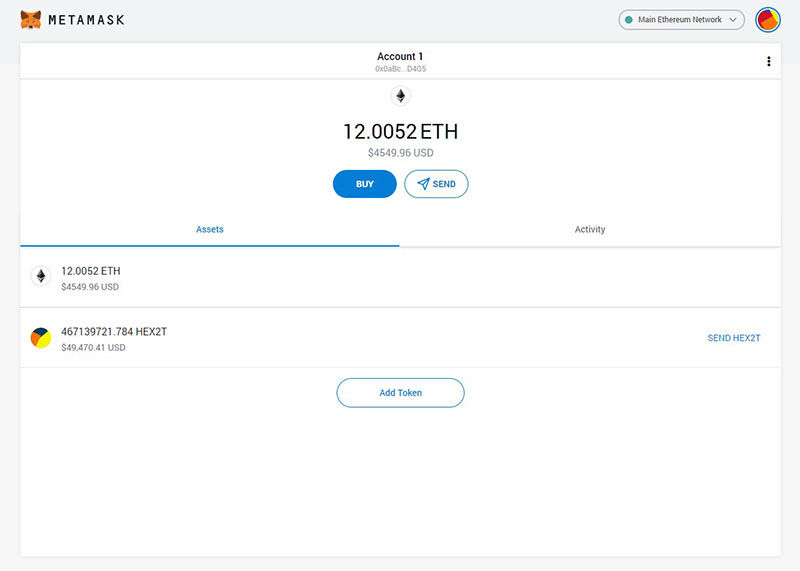

- Next you have to install the MetaMask browser extension. It may be installed in Chrome, Firefox, or Opera web browsers. For extra simplicity, it comes preinstalled in the Brave web browser, so you may want to grab a copy to save some setup time.

- Next, you’ll need to transfer the Ethereum you’ve purchased into MetaMask. To do this, just take your MetaMask wallet address back to your cryptocurrency exchange and perform a withdrawal to your new wallet. Be sure to get the wallet address right the first time – there’s no way to reverse a transfer if you make a mistake.

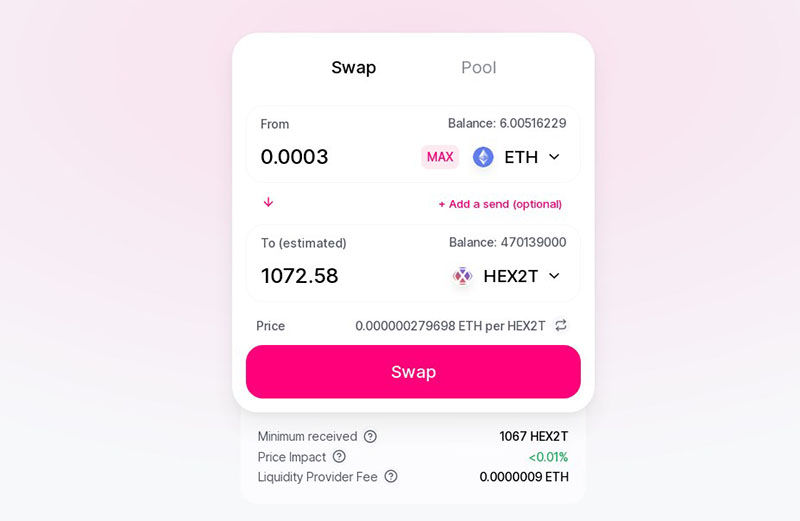

- Now, all you have to do is head over to Axion’s listing on the Uniswap Exchange. From there, you’ll be able to exchange Ethereum for Axion (HEX2T) tokens at the current prevailing rate. Simply enter the amount of Ethereum you’d like to exchange, and you’ll see an estimate of how much Axion it’ll yield.

If you’re happy with what you see, click the ‘Approve’ button at the bottom of the page. This will give Uniswap access to your Ethereum to validate the transaction. When it’s complete, the button will change to a ‘Swap’ button. After you click this button and approve the transaction in your wallet, you’re all set!

Ready to Earn

If you’ve made it this far, you should now know all you need to know about Axion. You know what it is, how it generates investment returns, and what makes it different from its predecessors. But you don’t have to take our word for it. All you have to do is take a look at Axion’s historical price chart to see how well it’s been doing for early adopters. And of course, you can follow Axion’s daily development by joining their Telegram or Discord channels. There, you can ask any questions you might have and members of the Axion team and other investors will be more than happy to answer them.

And remember, if you’re still on the fence about getting involved, take your time to understand the inner workings of Axion by talking to as many stakeholders as you can. Since Axion’s built for the long-term, you’ll still be able to earn excellent returns once you’re comfortable enough to buy-in. Sure, you might miss out on some of the stratospheric gains that will come as more people become aware of Axion, but you should only take on as much risk as you’re comfortable with. Either way, once you get started, you’ll be on your way to long-term principal growth and steady returns. Just try not to spend it all in one place!

By Andrej Kovacevic

Updated on 27th September 2021