Selecting the right business credit card can revolutionize how you manage expenses and improve cash flow. For instance, a small retail store might use a card to manage inventory costs or pay suppliers, earning cashback or rewards in the process. With interest-free periods and detailed monthly statements, business owners can streamline finances and focus on growth.

Here’s an updated list of the top 10 business credit cards in the UK, including the most current features and benefits.

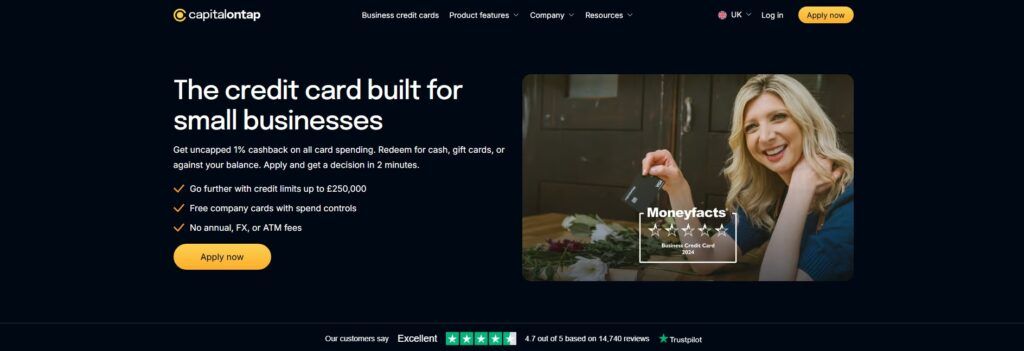

1. Capital on Tap, Business Visa cards

This card is specifically designed for small businesses, providing uncapped cashback and fee-free transactions.

Key Features:

- Uncapped 1% cashback: Redeem as cash, gift cards, or against your balance.

- Credit limit up to £250,000: Flexible limits for growing businesses.

- No fees: No annual, FX, or ATM fees.

- 24/7 support: Customer service responds within 10 seconds.

- Real-time visibility: Monitor spending and sync with accounting software automatically.

Eligibility:

Quick online application process with decisions in just 2 minutes. Apply Now.

2. Barclaycard, Flex Credit Card

The Barclaycard Flex Credit Card is ideal for startups and businesses needing flexible, low-cost solutions for transactions.

Key Features:

- Monthly rental: £15 plus VAT.

- Transaction cost: 1.6% per transaction.

- Flexible borrowing: Quick and simple application process.

- Representative APR: 24.9%.

Eligibility:

Suited for businesses with lower-value transactions. Call their helpline for personalized solutions.

3. HSBC, Commercial Card

The HSBC Commercial Card offers a secure, flexible way to manage expenses and optimize cash flow.

Key Features:

- Representative APR: 22% variable.

- Annual fee: £32 per card (waived for the first year).

- Extended repayment options: Manage large purchases with flexible repayment plans.

- Discounts on big brands: Offers available for cardholders through HSBC Business Offers.

Eligibility:

Available for businesses with established financial operations.

4. NatWest, Business Credit Card

NatWest provides a well-rounded credit card for businesses with turnover under £2 million.

Key Features:

- 1% cashback: Earn cashback at eligible fuel and EV charging stations.

- No annual fee for the first year; £30 thereafter.

- 56 days interest-free: When the balance is paid in full.

- Access exclusive offers via Business Savings from Mastercard.

Eligibility:

Minimum credit limit: £500. Rated 5 stars by Moneyfacts, ensuring reliability.

5. Yorkshire Bank, Business Credit Card

Yorkshire Bank combines anti-fraud measures with user-friendly tools to help businesses manage expenses.

Key Features:

- Interest-free credit: Up to 59 days on purchases.

- Anti-fraud technology: Includes chip and PIN, Mastercard Identity Check™.

- Online tools: SmartData system tracks and reports spending.

- Annual fee: £28 after the first year (free in year one).

Eligibility:

A business current account with Yorkshire Bank is required.

6. Santander, Business Credit Card

Santander offers a card that combines cashback with fee-free international transactions.

Key Features:

- 1% cashback: Unlimited cashback on all business spending.

- No foreign transaction fees: Pay in local currency without extra charges.

- Additional cards: No extra cost for supplementary cards.

- Representative APR: 23.7%.

Eligibility:

Annual fee: £30. Tailored for businesses with international spending needs.

7. Lloyds Bank, Business Credit Card

The Lloyds Bank Business Credit Card offers flexible borrowing and cashback rewards.

Key Features:

- Cashback: Earn 1% on fuel and charging, 0.5% on other purchases.

- Interest-free credit: Up to 56 days if balances are paid on time.

- Borrowing limit: Up to £25,000.

- Annual fee: Free for the first year, £32 thereafter.

Eligibility:

Applicants must hold a Lloyds business account and meet credit criteria.

8. TSB, Business Credit Card

TSB offers a business card with cashback rewards and flexible withdrawal limits.

Key Features:

- Cashback offer: £5 monthly cashback for six months with the Spend & Save account.

- Daily cash withdrawal limit: £500.

- Annual fee: £32 per card.

- Interest-free period: 45 days on purchases.

Eligibility:

Designed for businesses holding a TSB current account.

9. Royal Bank of Scotland, Business Credit Card

RBS combines tailored rewards with flexible spending options.

Key Features:

- Earn rewards for everyday spending and Direct Debits.

- Annual fee: £30 (waived for spending over £6,000 annually).

- Interest-free period: 56 days on purchases.

Eligibility:

Available to businesses with turnover under £2 million.

10. American Express, Business Gold Card

American Express provides premium benefits for businesses with high spending needs.

Key Features:

- Earn 4X points on the two top spending categories per billing cycle.

- Sign-up bonus: 70,000–100,000 Membership Rewards Points.

- Cashback value: Up to $395 annually through select merchant offers.

- Intro APR: 0% for six months, followed by variable rates (18.74%–27.74%).

Eligibility:

Requires U.S. purchases for rewards categories.

What Is a Business Credit Card and How Does It Work?

A business credit card is a financial tool that companies use to handle business-related purchases and withdrawals. Businesses should use credit cards exclusively for professional expenses, as this helps separate company finances from personal ones.

Business credit cards come with a predefined credit limit, which varies depending on the provider, the company’s financial details, and its overall financial health. These cards often include annual fees, but many providers offer an initial fee-free period to attract new users.

Just like personal credit cards, failing to pay the balance in full before the billing cycle ends may result in interest charges on the outstanding amount. This makes timely payments critical to avoid unnecessary costs.

Is It Worth Having a Business Credit Card?

Business credit cards offer several benefits that can help companies streamline their finances. For instance, a small consultancy firm might use a business credit card to cover daily expenses like office supplies and travel bookings, while simultaneously earning rewards like Avios points. These points could later be used for discounted business trips, reducing overall travel costs.

In addition to cash flow management, many cards offer rewards programs tailored for businesses. These may include cashback, points, or other bonuses for meeting specific spending thresholds within a set timeframe. For example, some cards provide free travel insurance or discounts on services that are valuable to businesses.

Furthermore, responsible use of a business credit card can help companies build a solid credit history. A good credit profile not only reflects financial stability but also increases the chances of securing favorable terms for loans or additional credit in the future.

How Do I Qualify for a Business Credit Card?

Eligibility for a business credit card depends on the provider and the specific features of the card. These cards aren’t limited to corporations—they are also available to freelancers and sole traders, offering an effective way to separate personal and business expenses.

Providers may have different criteria. For example, the Royal Bank of Scotland requires businesses to have a minimum annual turnover of £2 million to qualify for its business credit card. However, other providers cater to smaller businesses with lower turnover thresholds.

Tip for Applicants: Compare offers from multiple banks to find a card that matches your business needs. Look at factors like interest rates, annual fees, and additional perks to make the best choice.

Conclusion

A business credit card can be an indispensable financial tool for managing expenses, improving cash flow, and earning rewards. By choosing the right card, companies can gain access to flexible credit, streamline spending, and build a strong financial foundation.

When selecting a card, businesses should evaluate their needs, compare available options, and prioritize those that offer the best combination of benefits, fees, and rewards. With the right card in hand, managing business finances becomes simpler and more efficient, enabling long-term growth and stability.

By Andrej Kovacevic

Updated on 9th March 2025