Projection: Bitcoin Could Soar to $150,000 by 2030

This premier digital asset is poised to be a significant player in the coming years.

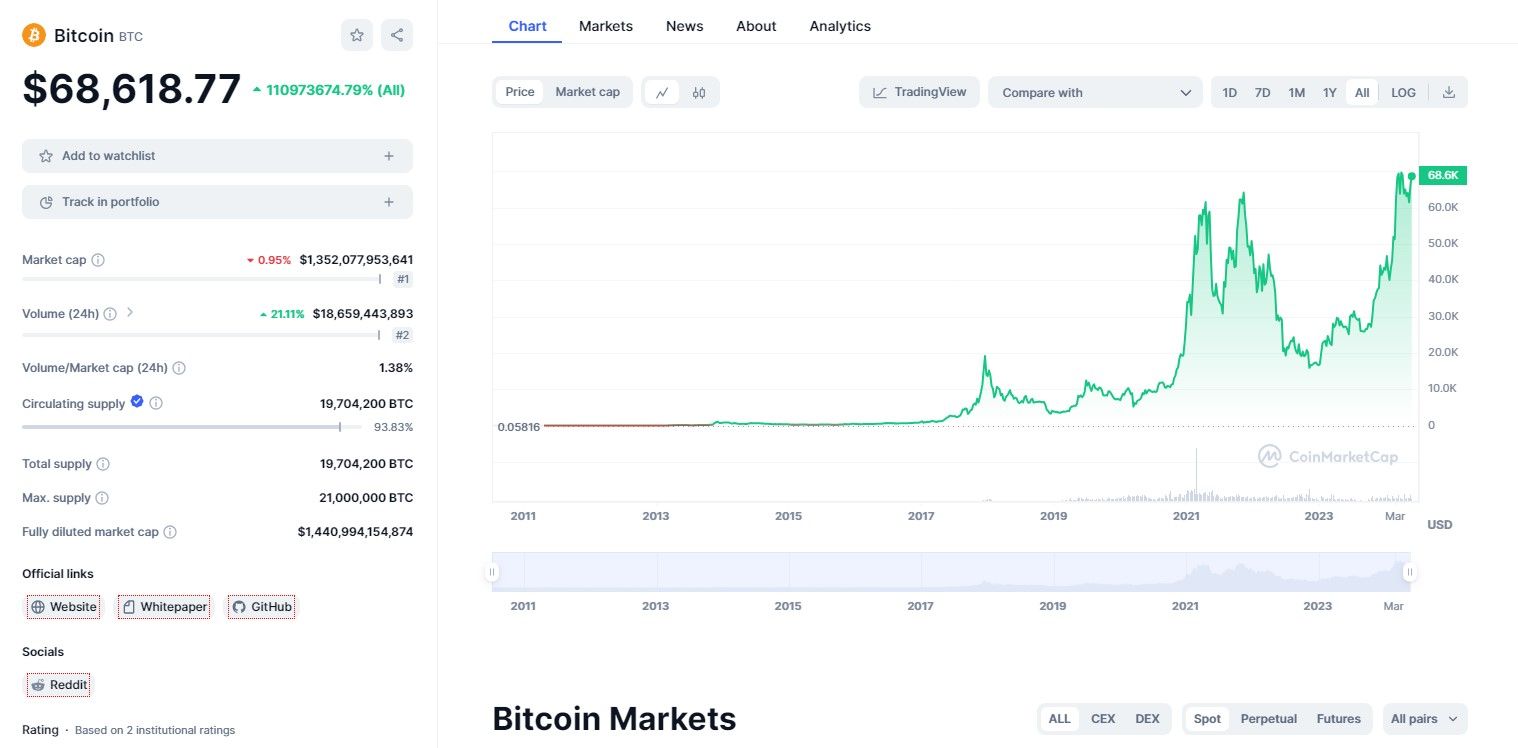

Over the last 18 months, Bitcoin (BTC – 1.16%) has witnessed a remarkable surge, escalating by 299% since early 2023. Although its ascent has moderated slightly, with a 6% drop from its peak in March, it currently stands at about $69,400.

For those pondering the timeliness of investing in the world’s most prized cryptocurrency, I project that Bitcoin will escalate to $150,000 by 2030, offering an annualized yield of 14%.

Slowing Gains

It’s critical to understand that the future gains of Bitcoin will likely not match its historic ascent. As the asset gains visibility, its rate of growth is expected to slow.

Despite my conservative stance, some industry titans have much loftier expectations. Cathie Wood and her team at Ark Invest anticipate Bitcoin might reach $3.8 million by 2030. Meanwhile, Jack Dorsey of Block envisions a $1 million valuation per Bitcoin by the decade’s end.

Given these perspectives, my forecast of $150,000 appears cautious, yet it still promises to outperform the average returns of the S&P 500. Traditionally, this index has returned about 10% on an annualized basis.

Demand Surge

The principal driver behind Bitcoin’s future value will likely be its broader adoption among individual and institutional investors, as well as governments and corporations. Increased ownership should theoretically elevate Bitcoin’s market price.

But what draws these participants to Bitcoin? The cryptocurrency’s fixed supply of 21 million coins, combined with a diminishing rate of new coins, creates a scarcity that enhances its appeal compared to the inflationary trends of traditional currencies.

For instance, consider the U.S. government’s expansive deficit, which exacerbates the national debt. In contrast, the supply of U.S. dollars continues to grow, eroding its purchasing power.

Navigating Uncertainties

While optimistic, my prediction of Bitcoin reaching $150,000 by 2030 is not guaranteed. The path of new technologies is often fraught with volatility and uncertainty.

Investors should consider moderating their Bitcoin investments to a small fraction of their portfolios, ideally around 1%. Such an allocation mitigates risk while allowing participation in potential gains.

Mentally, investors must prepare for significant price fluctuations. Bitcoin has endured several declines exceeding 50% in its relatively short history. Although it may stabilize over time, these sharp downturns are par for the course.

For those considering Bitcoin, a long-term view is essential. Despite the ups and downs, Bitcoin remains a promising asset on its path to reaching $150,000 by 2030.

By Andrej Kovacevic

Updated on 14th July 2024