The company’s spot Bitcoin ETF has pulled in $513 million up until now, and it foresees a promising future for Ethereum as well.

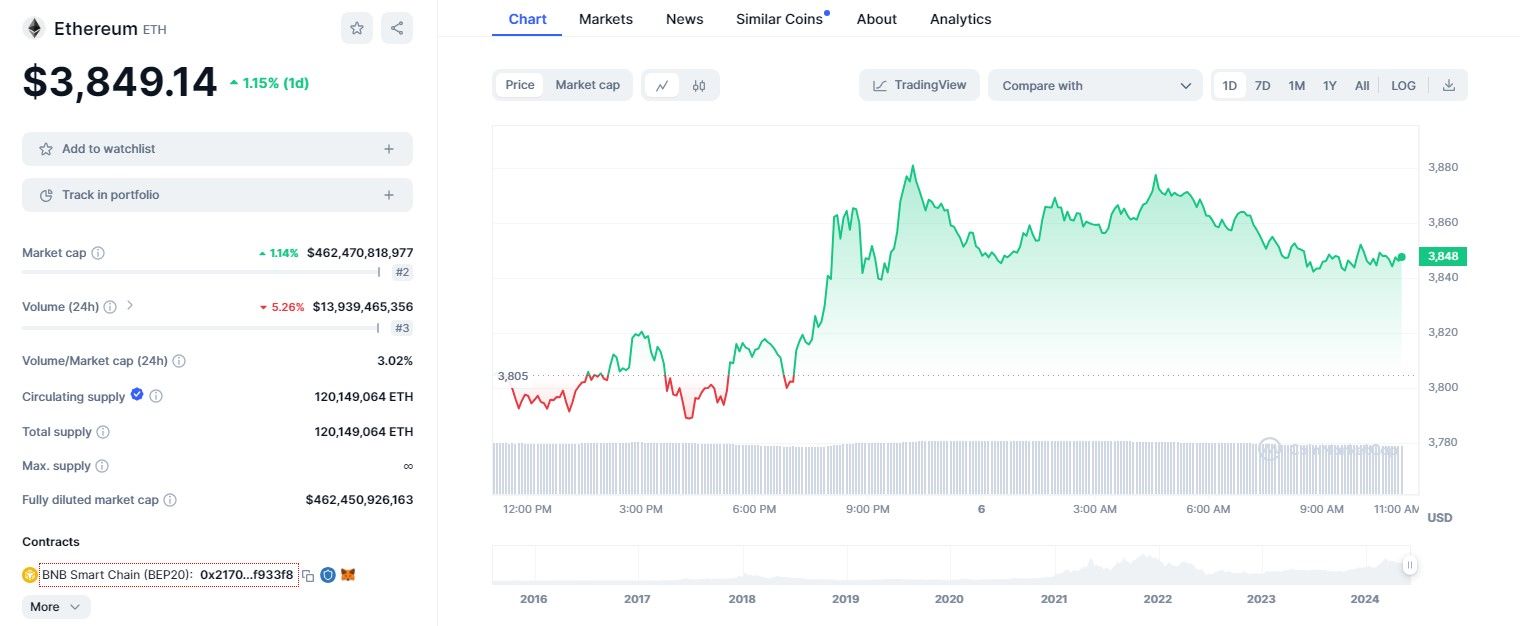

Global asset manager VanEck predicted on Wednesday that Ethereum’s price will soar to $22,000 by the end of the decade, describing the cryptocurrency as “digital oil” in their latest report. This would mark a 468% increase from Ethereum’s current value.

While Ethereum has generated $3.4 billion in revenue over the past year, VanEck also anticipates this figure could reach $51 billion by 2030.

“We see ETH as a revolutionary asset with few comparisons in the traditional financial world,” the report stated. “The Ethereum network is expected to continue its rapid growth in market share from traditional financial market participants and increasingly from major tech companies.”

VanEck characterized Ethereum as the centerpiece of its own financial system, with its network currently securing over $90 billion in stablecoins, around $7 billion in tokenized assets, and $308 billion in digital assets.

Simultaneously, VanEck envisions Ethereum expanding its reach beyond crypto. Given the breadth of business sectors that applications built on Ethereum could disrupt, VanEck estimates that the network’s total addressable market stands at $15 trillion. These opportunities lie primarily in finance, banking, and payments, according to VanEck.

Ethereum could also find roles in infrastructure, artificial intelligence, marketing, advertising, social media, and gaming, the firm added.

The report highlighted several unique aspects of Ethereum as both a network and an asset, from its nature as “programmable money” to a “yield-bearing commodity.” Notably, VanEck’s report refers to Ethereum as an “internet reserve currency,” essential to its vast ecosystem and layer-2 networks.

VanEck’s report follows shortly after the Securities and Exchange Commission’s approval of spot Ethereum ETFs. This allows mainstream investors to gain exposure to the cryptocurrency in a traditional brokerage account, which has implications for Ethereum’s regulatory status.

For those within the crypto community, the concept may seem fundamental, but VanEck emphasized its significance: to send Ethereum or engage with smart contracts, users must spend Ethereum on gas fees, which are then removed from circulation through burning. Essentially, VanEck noted that this mechanism benefits Ethereum holders in two ways: it creates demand while simultaneously reducing supply.

VanEck also expects Ethereum to challenge established tech giants like Google and Apple as a platform for developers to create consumer-facing applications. While these companies take around 30% of revenue from apps hosted in their respective digital stores, VanEck noted that Ethereum currently captures around 24% of revenue through gas fees.

“Compared to data-driven social networking platforms like Facebook, we believe Ethereum may enable more efficient and profitable applications for entrepreneurs,” the report stated. “As more data is generated publicly and more commerce is moved off expensive, closed financial systems, business models will erode.”

By Andrej Kovacevic

Updated on 6th June 2024