Cryptocurrency exchanges have become indispensable tools for investors navigating the dynamic world of digital assets. Whether you are a novice or a seasoned trader, selecting the right exchange can significantly influence your trading experience and outcomes. With a wide range of platforms available, each offering unique features, security protocols, and fee structures, choosing the ideal exchange requires careful consideration of your trading priorities.

This article delves into the evolution of cryptocurrency exchanges, highlights the top platforms available today, and provides insights into what makes these platforms stand out.

The Evolution of Crypto Exchanges

Since the inception of Bitcoin in 2009, cryptocurrency exchanges have undergone profound transformations. Initially, these platforms served as simple marketplaces for Bitcoin transactions, with limited functionality and user engagement. As the cryptocurrency ecosystem expanded, exchanges evolved to support multiple digital assets, offering advanced features and bolstered security measures.

Modern exchanges cater to diverse user bases, ranging from casual traders to institutional investors. Features like margin trading, staking, futures, and automated trading tools have become standard offerings. This evolution is a result of increased demand, regulatory advancements, and technological innovations aimed at enhancing blockchain security and scalability.

Top 8 Crypto Exchanges for Advanced Trading Opportunities

Below is a detailed overview of the leading cryptocurrency exchanges that are shaping the market in 2024.

1. Binance

Founded in 2017 by Changpeng Zhao (CZ), Binance has rapidly ascended to become the world’s largest cryptocurrency exchange by trading volume. Initially, Binance focused on offering a wide variety of cryptocurrencies, but it has since diversified its services to include:

- Futures trading

- Margin trading

- Staking and DeFi products

- NFT marketplaces

Why Choose Binance?

- Low transaction fees

- Advanced security protocols, including SAFU (Secure Asset Fund for Users)

- Binance Coin (BNB) for discounted fees

- A user-friendly interface suitable for all experience levels

Binance’s commitment to innovation ensures it remains at the forefront of the cryptocurrency market.

2. Kraken

Founded in 2011 by Jesse Powell in San Francisco, Kraken is one of the oldest and most reputable exchanges in the industry. Kraken’s key features include:

- A wide selection of cryptocurrencies

- High liquidity for smooth trading

- Futures trading and staking services

- Advanced security features, such as cold storage and encrypted communication

What Sets Kraken Apart?

- Tailored services for institutional investors

- An intuitive interface for retail traders

- Robust regulatory compliance

Kraken’s strong emphasis on security and regulatory adherence makes it a trusted platform for traders worldwide.

3. Bitfinex

Launched in 2012 and headquartered in Hong Kong, Bitfinex has established itself as a go-to platform for professional traders. The platform specializes in advanced trading features, including:

- Margin trading with up to 10x leverage

- Lending and borrowing services

- Deep liquidity for high-volume trades

Security and Trust:

- Multi-signature wallets

- Advanced encryption protocols

Bitfinex has rebuilt user trust following a significant hack in 2016, solidifying its position as a leading exchange.

4. OKX (Formerly OKEx)

Launched in 2014 in Malta, OKX offers a comprehensive suite of services tailored for both retail and institutional investors. Key offerings include:

- Spot and futures trading

- Staking services

- NFT marketplaces

Unique Selling Points:

- High liquidity and low trading fees

- Robust security protocols

- A diverse range of products catering to various expertise levels

5. Bitstamp

Established in 2011 in Luxembourg, Bitstamp is known for its user-friendly design and regulatory compliance. As one of the oldest exchanges, Bitstamp has built a reputation for reliability and security. Key features include:

- Strong security measures, such as two-factor authentication and cold storage

- Support for a wide range of cryptocurrencies

- Low trading fees

Why Bitstamp?

- Reliable customer support

- Commitment to regulatory compliance

- Ideal for both beginners and experienced traders

6. Coinbase

Founded in 2012 in San Francisco, Coinbase is renowned for its simplicity and transparency. It has become a household name, particularly among beginners. Notable features include:

- An intuitive interface for easy navigation

- Staking services for earning passive income

- Crypto savings accounts

Advantages:

- Publicly traded, enhancing credibility

- Strong regulatory compliance

- Beginner-friendly tools alongside advanced trading options

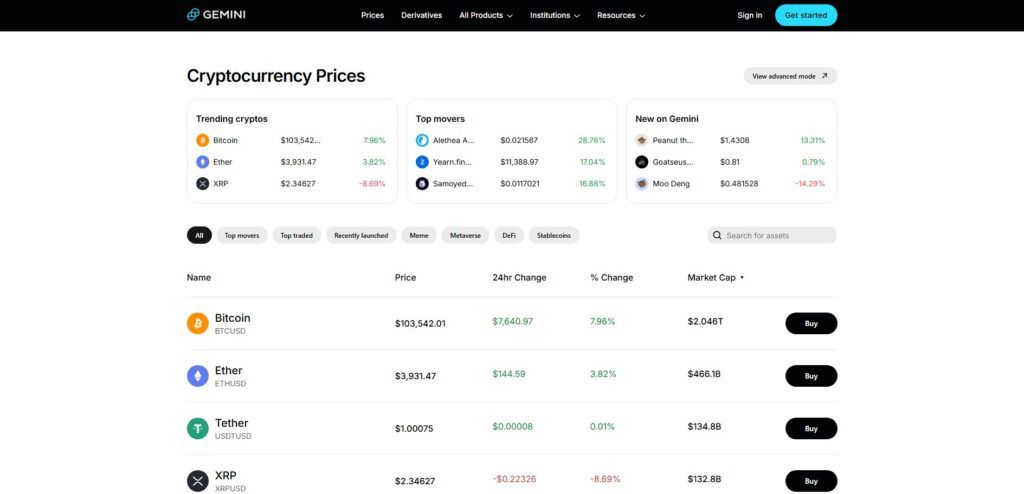

7. Gemini

Launched in 2014 by the Winklevoss twins, Gemini is a New York-based exchange that prioritizes security and regulatory compliance. Key features include:

- Insured custodial assets

- Advanced trading tools for institutional investors

- A user-friendly interface for retail traders

Why Gemini?

- Strong focus on security

- Regulatory adherence

- Versatile platform for both beginners and pros

8. Crypto.com

Based in Hong Kong, Crypto.com has emerged as a versatile platform offering a range of services beyond traditional trading. Highlights include:

- A DeFi wallet for secure storage

- Cashback rewards through its payment card

- A vast selection of cryptocurrencies

Benefits:

- Consumer-friendly incentives

- Robust ecosystem for new and experienced users alike

Key Trends in the Crypto Exchange Landscape

The crypto exchange industry continues to evolve rapidly. Here are some emerging trends to watch:

Decentralized Exchanges (DEXs):

Platforms like Uniswap and PancakeSwap are gaining traction for offering peer-to-peer trading without intermediaries. This trend reflects the growing demand for decentralized finance (DeFi) solutions.

Integration with Traditional Finance:

More exchanges are bridging the gap between cryptocurrencies and traditional finance by enabling fiat deposits, withdrawals, and hybrid trading options.

Enhanced Security Protocols:

With cyber threats on the rise, exchanges are adopting advanced security measures, such as biometric authentication and real-time fraud detection.

Sustainability Initiatives:

Environmental concerns are prompting exchanges to explore green energy solutions and carbon-offsetting programs to address the ecological impact of cryptocurrency mining and trading.

Choosing the Right Exchange

Selecting the ideal cryptocurrency exchange depends on your trading goals and priorities. Here are some factors to consider:

- Security Measures: Look for platforms with strong encryption, two-factor authentication, and cold storage.

- Fee Structures: Evaluate trading fees, withdrawal costs, and potential discounts.

- User Interface: A beginner-friendly interface is crucial for new traders.

- Supported Cryptocurrencies: Ensure the platform supports the assets you wish to trade.

- Advanced Features: Consider features like staking, futures trading, and automated tools if you have advanced needs.

- Regulatory Compliance: Platforms with strong compliance offer added trust and credibility.

Cryptocurrency exchanges play a vital role in the digital asset ecosystem, offering platforms for trading, staking, and beyond. As the market continues to grow, understanding the strengths and features of top exchanges like Binance, Kraken, Bitfinex, and others can help you make informed decisions aligned with your trading goals.

By prioritizing security, user experience, and advanced features, these exchanges empower traders to unlock new opportunities in the ever-evolving crypto landscape. Staying informed about industry trends and technological advancements will ensure you remain at the forefront of this exciting financial revolution.

By Radoslav Jokic

Updated on 9th March 2025