For the first time in a decade, AMD has pulled ahead of Intel in terms of raw sales. With the recent release of the RX Vega and their line of Threadripper CPUs, combined with their well-rated performance and the momentary stagnation in the market, it’s not the worst time to invest in AMD.

The catch? They’ve specifically outsold Intel in CPU sales in Germany, albeit from Germany’s largest computer hardware retailer. It’s still good news for the company as a whole, however, and AMD’s latest string of products have been successful enough that shortages aren’t entirely unheard of.

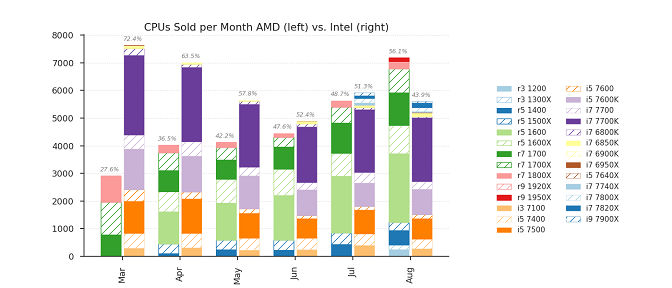

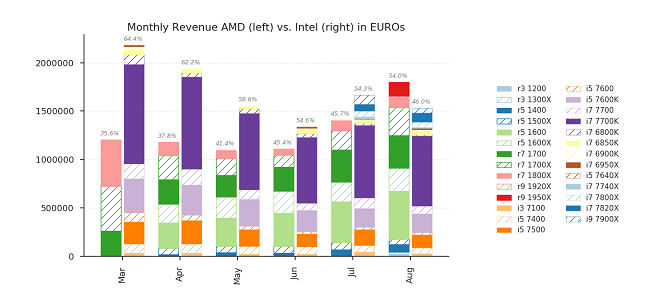

The raw numbers

According to Mindfactory, AMD’s line of CPUs have outpaced Intel’s processor offerings as of this August. Considering the Threadripper line only launched a month ago, a surge of sales as strong as AMD has experienced is almost certain to lead to strong quarterly showings for the company.

Earlier reports claimed AMD saw an increase in market share as large as 10%, though that has been disputed by some outlets regarding just how feasible those numbers are. Even if the true market share shift earlier this year only amounted to two percent, it’d be a serious boost to the company when combined with the successful launch of the Threadripper series.

The downsides

AMD may be doing well in raw numbers, but they’re having issues supplying some of those numbers on alternate fronts. The release of their Vega cards has been met with acclaim, only for shortages and unmet orders to cut off part of the launch’s success at the knees. With the recent popularity of mining digital currency and its strong benchmarks, especially for currency mining purposes, finding a Vega for sale that isn’t back-ordered for months is already becoming an issue.

Both the RX Vega 56 and 64 outperform a wide array of cards when it comes to mining, beaten out only by the GeForce GTX 1080 Ti and the Titan XP. With performance differences being negligible at best, picking up a new Vega card is a much more attractive option financially and offers a small measure of future-proofing for mining rigs, at least for the time being.

As is often the issue with cards used for mining, expect a large batch of cards to enter the secondhand market once the price of Ethereum and other digital currencies stabilise or lower to the point where it is no longer profitable. The expected time frame for this to happen often varies and you should be wary of these secondhand cards to ensure they’re still in proper working order, as months of mining can cause stress to the cards, but properly cooled models should be no worse for wear than other used GPUs.

The bottom line for AMD

Market share overconfidence aside, projections show AMD’s stock prices rising to 18 dollars a share and possibly beyond. Shortages seem to have no current effect on the company, considering how often GPUs are short of stock at the time of release. If anything, the mining frenzy has only pushed up demand for the cards and established a solid user base for AMD. If their CPU division continues to grow they just might be set to keep a solid handle on the consumer market they’ve been lacking for some time now.

By Andrej Kovacevic

Updated on 4th February 2020